Sally Beauty (NYSE:SBH) shares surged by 10% today after the beauty products and solutions provider’s fourth-quarter results were characterized by robust margin expansion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

During the quarter, revenue declined by 4.3% year-over-year to $921 million, and EPS of $0.42 missed expectations by $0.04. Further, consolidated comparable sales declined by 1.6%. On the other hand, the company’s gross margin expanded by 240 basis points to 50.6% and operating free cash flow came in at a healthy $90 million.

Amid a challenging macro environment, Sally Beauty remains focused on driving top-line growth and improving its profitability. Additionally, its recent asset acquisition from New York-based Goldwell is expected to result in an incremental sales gain of 1% in its Beauty Systems Group segment in Fiscal Year 2024.

For Fiscal Year 2024, Sally Beauty expects net sales and comparable sales growth to be flat compared to the prior year, reflecting pressures in consumer spending. The company anticipates operating cash flow of at least $260 million and a gross margin of over 50% for the year.

What Is the Price Target for SBH?

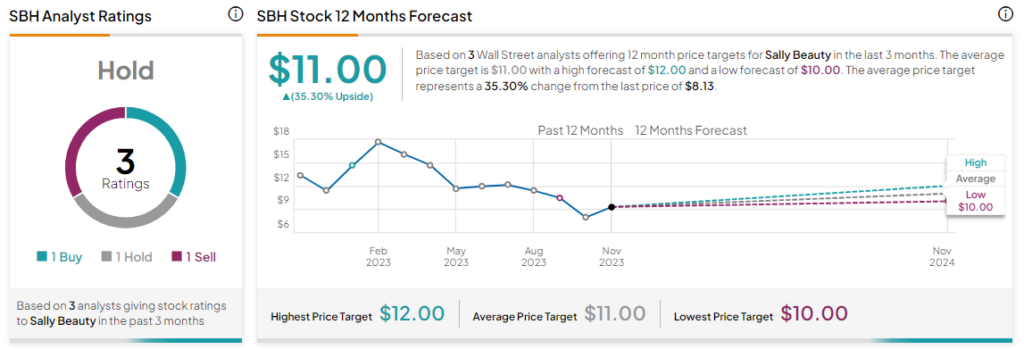

Overall, the Street has a Hold consensus rating on Sally Beauty. Following a nearly 29% slide in its share price over the past six months, the average SBH price target of $11 implies a 35.3% potential upside.

Read full Disclosure