Royal Dutch Shell announced the sale of a 26.25% stake in Queensland Curtis LNG (QCLNG) Common Facilities to Global Infrastructure Partners Australia, for $2.5 billion.

Following the divestment, Royal Dutch Shell (RDS.A) will remain the majority owner and operator of the Queensland facilities site by retaining a 73.75% stake.

The common facilities site includes LNG storage tanks, jetties, and operations infrastructure that service QCLNG’s LNG trains.

This decision is consistent with the oil and gas company’s strategy to divest its non-core assets in a move to enhance and streamline Shell’s portfolio, the company said.

The transaction, which is subject to regulatory approval in Australia, is expected to be completed in the first half of 2021.

Royal Dutch’s stock price has lost 37% year-to-date and is trading at a discount of 39% to its 52-week high. (See RDS.A stock analysis on TipRanks)

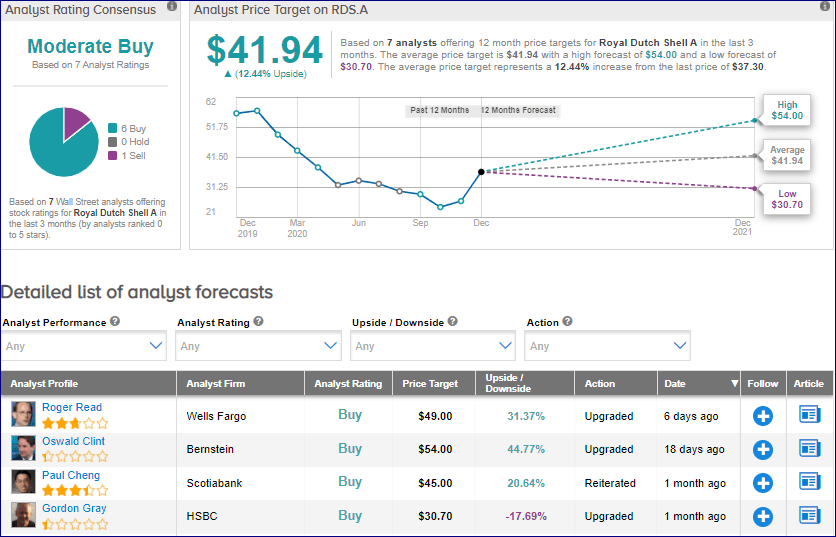

Earlier this month, Bernstein analyst Oswald Clint upgraded the stock to Buy from Hold with a $54 price target. 3. The price target implies that investors could be gaining 45% over the coming 12 months.

Clint noted that with the fear of a dividend cut out of the way following the “surprise” Q3 dividend boost, Shell’s cash flow story is “now too good to ignore.”

From the rest of the Street, the stock scores a cautiously optimistic Moderate Buy analyst consensus based on 6 Buys and 1 Sell. The average price target of $41.94 implies upside potential of 12.4% to current levels.

Related News:

Microsoft To Develop Its Own Chips For Servers, PCs – Report

PPG To Snap Up Tikkurila In $1.35B Deal; Street Is Cautiously Optimistic

Blackstone In Talks To Merge Alight With Foley – Report