Shares of Roku gained about 4.5% in Wednesday’s market extended trading as the video streaming platform reached a deal with AT&T’s Warner Media to bring HBO Max Service on its devices, starting from Dec. 17.

Roku (ROKU) said that from Dec. 17 its users “will be able to download HBO Max from the Roku channel store and subscribe directly on their Roku device to access all of HBO Max, which includes 10,000 hours of curated premium storytelling from the iconic brands of HBO, Warner Bros., DC, Adult Swim and much more.”

The company’s deal with HBO Max comes just a week ahead of the highly anticipated superhero movie ‘Wonder Woman 1984’, which will debut simultaneously in theaters and on HBO Max on Dec. 25. Therefore, HBO Max subscribers can directly watch the movie on their Roku devices at no additional cost. (See ROKU stock analysis on TipRanks)

Scott Rosenberg, the senior vice president of Roku’s platform business said, “We believe that all entertainment will be streamed and we are thrilled to partner with HBO Max to bring their incredible library of iconic entertainment brands and blockbuster slate of direct to streaming theatrical releases to the Roku households with more than 100 million people that have made Roku the No. 1 TV streaming platform in America.”

On Dec. 11, Merrill Lynch analyst Ruplu Bhattacharya maintained a Buy rating on the stock and lifted the price target to $360 (10.5% upside potential) from $310. The analyst believes that Roku stock has an attractive valuation and is executing well against its strategy of delivering increased scale, engagement and ad monetization. He noted, “First time advertiser clients more than doubled y/y in 3Q driven by performance marketers using the OneView platform, as well as advertisers focused on new products like incremental reach guarantees.”

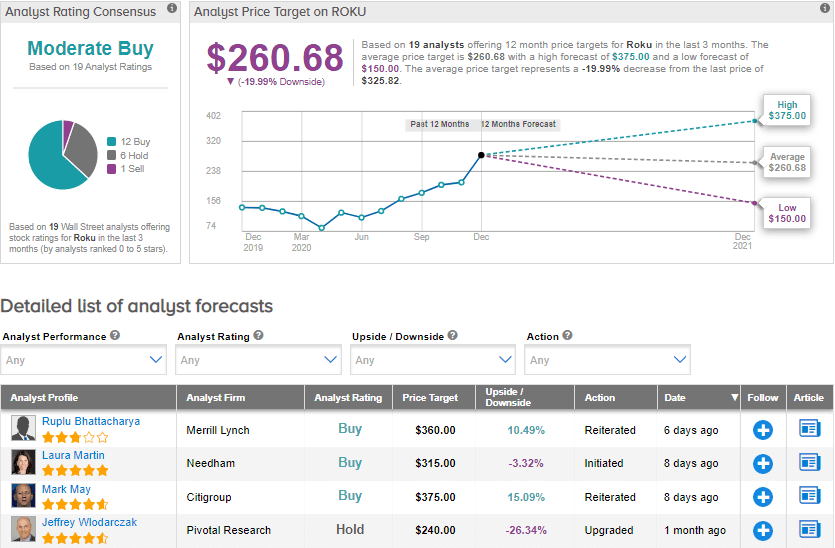

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 12 Buys, 6 Holds and 1 Sell. Following this year’s stock rally of 143.3%, he average price target stands at $260.68 and implies downside potential of about 20% to current levels.

Related News:

Quest Lifts 2020 Sales, Profit Guidance As Covid-19 Testing Picks Up

Aspen Group Sinks 7% On Higher 2Q Loss; Street Stays Bullish

Dixons Pops 15% As Online Sales Go Through The Roof; Street Sees 10% Downside