It should have been enough to push video game stock Roblox (NYSE:RBLX) into positive territory after it got a great shot of love from analysts at RBIG. Investors, however, felt little of that love themselves, and Roblox turned fractionally negative in Thursday morning’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The word out of BTIG—via analysts Clark Lampen and Joseph Spiezio—points out that Roblox stock has already seen its share of gains this year, up 43% against this time last year. But despite this, Roblox may have more life in it, thanks to a combination of factors, including a still-reasonable valuation, notable cash flow numbers, and a few other points. Though the overall environment might still prove “challenging” for gaming—especially for mobile gaming—Roblox’s critical advantages of “stable” bookings and cash flow should provide a level of protection from the turbulence in the broader sector.

Roblox’s Advantage – An Evolving Platform

One advantage Roblox has over its contemporaries is its constantly evolving platform. Roblox recently took some child-friendly guard rails off some communities, allowing users to use profanity and other “strong language” in chat functions. However, there are still strict rules, including outright prohibitions on violence and harassment, among other things, and “public-facing content” must still be “appropriate for players of all ages.”

What is a Fair Price for Roblox Stock?

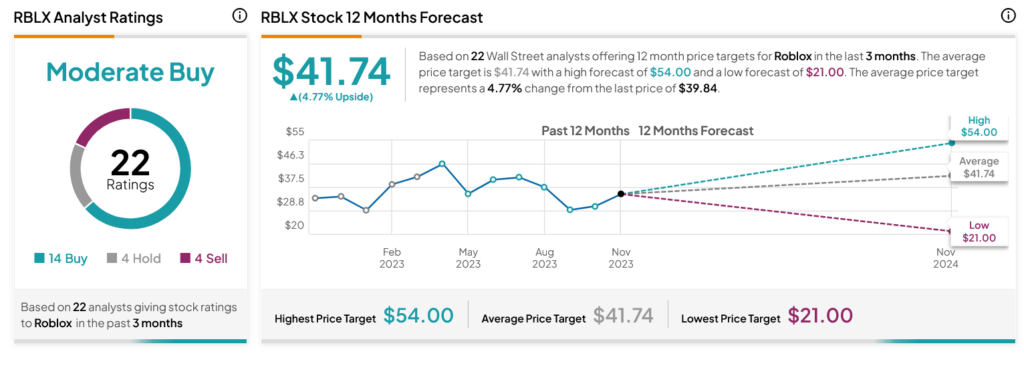

Turning to Wall Street, analysts have a Moderate Buy consensus rating on RBLX stock based on 14 Buys, four Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 25.09% rally in its share price over the past year, the average RBLX price target of $41.74 per share implies 4.77% upside potential.