Robinhood Markets, Inc. (NASDAQ: HOOD), which was launched in 2013 as a financial services company, experienced an ever-increasing number of users after launching a commission-free stock trading app in 2015. On this brokerage, investors can trade stocks, exchange-traded funds, and cryptocurrencies. As of 2021, Robinhood had 31 million users.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The online trading platform recorded a whopping gain of 24.2% at the close on Tuesday, after it extended the trading time by four hours, with the hope of combating slow growth due to reduced trading volumes despite expanding in segments like crypto wallets and cash cards. This is a step further toward 24/7 trading to be initiated by the company in the coming period.

Now, the trading time extends from 7 a.m. to 8 p.m. Eastern Time, compared to the prior timing schedule of 9 a.m. to 6 p.m. Eastern Time. Previously, it used to start 30 minutes before the NYSE opened and ended two hours after the market close.

According to Robinhood, customers were facing difficulties in trading during the prior time frame. It stated, “Our customers often tell us they’re working or preoccupied during regular market hours, limiting their ability to invest on their own schedule or evaluate and react to important market news.”

The blog post continued stating that “Our new extended trading hours for equities will give them more opportunities to manage their portfolio at a convenient time for them, whether that’s in the early morning or in the evening.”

Nearly recording three-fourths of its revenue are generated from trading activities, Robinhood is now on the bandwagon of its competitors, including brokerage firms Charles Schwab (SCHW) and Interactive Brokers (IBKR), which already offer extended trading hours.

Investors Remain Cautious

Recently, Deutsche Bank analyst Brian Bedell reiterated a Hold rating on Robinhood but lifted his price target to $14 (12.01% downside potential) from $12.

Overall, the stock has a Hold consensus rating based on five Buys, five Holds, and two Sells. The average Robinhood price target of $19 implies 19.42% upside potential to current levels. Shares have decreased 12.6% over the past three months.

Robinhood gets a 7 out of 10 on TipRanks’ Smart Score ranking, suggesting that HOOD is likely to perform in line with market averages.

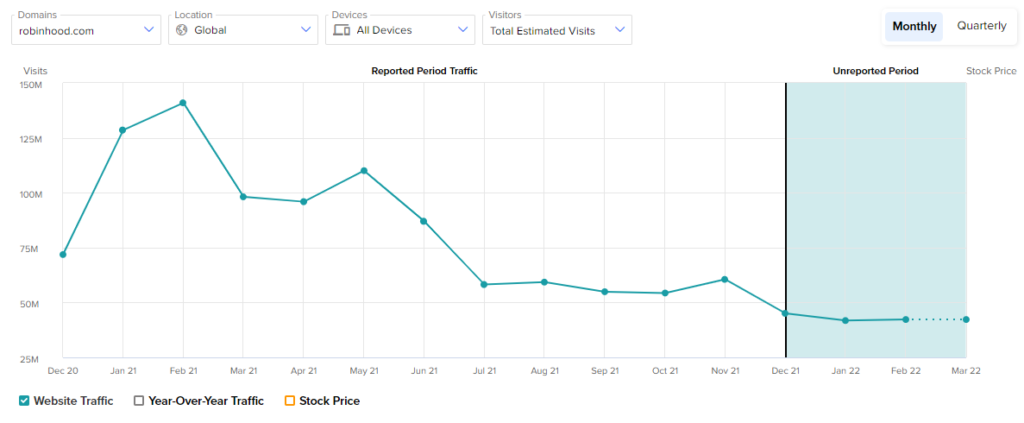

Estimated Monthly Visits

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), offers insight into Robinhood’s performance.

According to the tool, the Robinhood website recorded a 7.26% decrease in global estimated visits in January compared to the month of December, while it recorded a 1.14% gain in February compared to January. Therefore, it is difficult to infer how the company’s revenues and profitability will perform in the coming period.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Tesla Halts Production at Shanghai Factory Amid China Lockdown – Report

Merck Obtains Positive CHMP Opinion for KEYTRUDA

AMC Entertainment Skyrockets on CEO’s Inspiring Comments