Robinhood Markets (NASDAQ:HOOD) has agreed to pay $10.2 million to seven U.S. states as a penalty for platform disruptions that happened in March 2020. As a result of the outage, the company’s users missed out on the opportunity to trade on pandemic-driven volatility.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company facilitates commission-free trades of stocks, exchange-traded funds, and cryptocurrencies as well as individual retirement accounts, through its mobile app.

The charges are the result of a multi-state investigation conducted into Robinhood’s operational deficiencies. The probe concluded that the company failed to give accurate margin and risk-related information, did not conduct proper due diligence prior to approving some option accounts, and offered inadequate customer support.

The allegations have not been refuted or admitted by Robinhood. State regulators from Alabama, Colorado, California, Delaware, New Jersey, South Dakota, and Texas conducted the investigation.

These legal issues continue to impact Robinhood’s financials to some extent. In 2021, the company had to pay a hefty fine of $70 million to the Financial Industry Regulatory Authority.

The regulator claimed that Robinhood’s compliance lapsed during the March 2020 outage and that it had been deceiving customers since 2016. Furthermore, the SEC is currently looking into the company’s cryptocurrency operations.

Is HOOD a Good Stock to Buy?

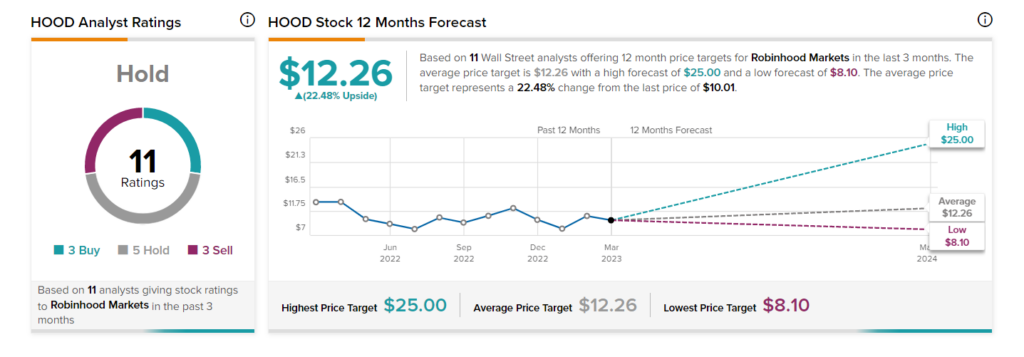

On TipRanks, HOOD stock has a Hold consensus rating based on three Buys, five Holds, and three Sells. Also, the average price target of $12.26 implies 22.5% upside potential from current levels.