Electric vehicle (EV) maker Rivian Automotive, Inc. (NASDAQ: RIVN) saw its shares rise 6.8% on August 8. The upside could have been driven by the Senate passing the $433 billion climate bill called the Inflation Reduction Act. The company is all set to release its earnings results for the second quarter of 2022 on August 11, after the market close.

The Inflation Reduction Act: What’s in It for EV Makers?

The Inflation Reduction Act aims at extending the $7,500 per vehicle tax subsidy that has existed since 2009. However, this consumer tax credit for purchasing an electric vehicle will not be applicable for new cars that are priced at more than $55,000, and SUVs, pickup trucks, and vans at $80,000.

Limiting the tax credits for higher-income consumers, the bill states that buyers with household income above $150,000 for individuals and $300,000 for married couples will not be eligible for tax credits.

The proposed new legislation will also eliminate the $200,000-vehicle upper limits for car companies. This threshold leads to a phaseout of the tax credit on the EVs of the companies like Tesla and GM that have crossed this upper limit.

However, the bill requires at least half of the battery raw materials and components used in the EV to be produced or assembled in the United States to be eligible for the credit.

Some industry players, including Rivian, looked unhappy with certain requirements to qualify for the tax credit. They have claimed that these will put them in a disadvantageous position in comparison to the other large and established players in the industry, a Wall Street Journal report stated.

Moving on, with Rivian’s second-quarter results scheduled to release soon, let’s take a look at the consensus expectations and the factors that might have influenced its results.

Consensus Estimates for Q2

For the second quarter of 2022, analysts expect Rivian to post a loss of $1.63 per share. Further, the consensus estimate for the company’s revenues stands at $337.52 million.

According to the company, it is on track to meet its annual delivery guidance of 25,000 vehicles in 2022. In the second quarter, the company produced 4,401 vehicles at its Illinois-based manufacturing facility. The EV maker delivered 4,467 vehicles during the same period.

Is RIVN a Good Stock to Buy?

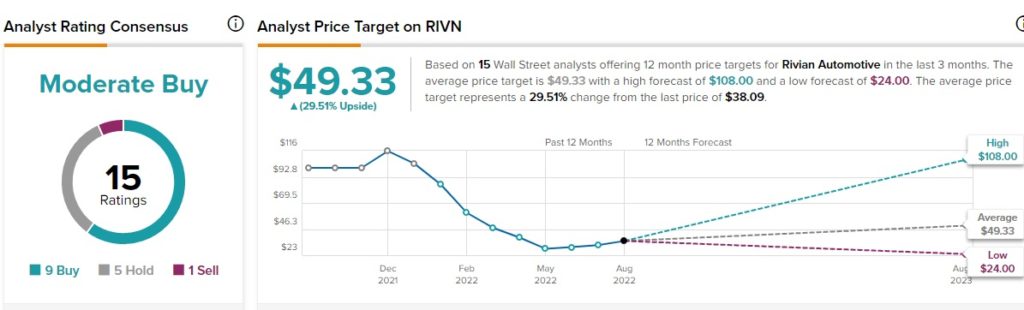

As of now, the Street has mixed feelings about Rivian. On TipRanks, RIVN stock carries a Moderate Buy consensus rating, which is based on nine Buys, five Holds and one Sell.

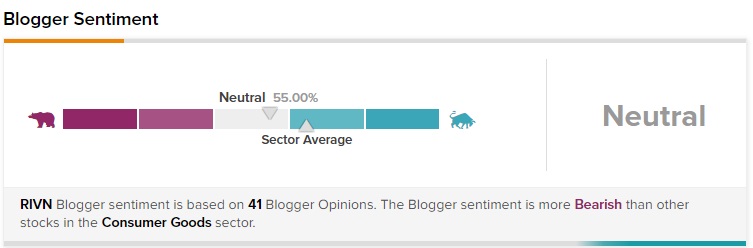

Financial bloggers on TipRanks are 55% Neutral on RIVN, compared to the sector average of 65%. News sentiment is also Neutral for the stock.

Final Thoughts

Shares of Rivian are down 62.9% year-to-date. The company has been facing severe supply-chain and other macroeconomic challenges. However, the company’s decent production numbers last month have instilled optimism among investors.

Considering the current situation, investors can wait on the sidelines and watch how the stock performs in the second quarter of 2022, especially after EV maker Lucid’s (LCID) disappointing second-quarter revenues and slashed production guidance for 2022.

Read full Disclosure.