Rivian Automotive (RIVN) plans to lay off about 5% of its workforce, mainly targeting non-manufacturing roles. According to a Bloomberg report, the cuts are in the planning stage and could affect hundreds of people. The cuts will target areas where the company has grown too quickly and teams with duplicate functions. Rivian plunged 6.4%, closing at $29.93 on July 11.

Economic Outlook Concerns for RIVN

The Irvine, California-based manufacturer is pulling back after doubling its headcount over the past year as it sought to ramp up production. It currently employs more than 14,000 employees, most of whom work on the development of electric pickups, delivery vans, and sport utility vehicles (SUVs).

Rivian joins a number of companies that have embarked on a restructuring drive owing to growing concerns about the economic downturn. According to a Bloomberg report, Tesla (TSLA) has already announced plans to cut 10% of its salaried workforce after CEO Elon Musk reiterated that a recession is inevitable.

Rivian Stock’s Underperformance

After going public late last year, Rivian has come under immense pressure due to global supply chain issues and a shortage of parts. Recently, electric vehicle (EV) sales have come under pressure, with consumers put off by high prices amid high inflation levels.

According to CNBC, Rivian shares surged amid intense investor interest after going public last year. However, struggles in ramping up production, compounded by global supply chain disruptions, have seen the stock come under pressure, shedding more than 80% of its 52-week highs. According to Bloomberg, the automaker had about $17 billion in cash and restricted cash as of the end of March, which should help it weather the storm.

Wall Street’s Take on RIVN

The Street is optimistic about the stock, with a Moderate Buy consensus rating, based on eight Buys, five Holds, and one Sell. The average Rivian price target of $50.14 implies 67.52% upside potential from current levels.

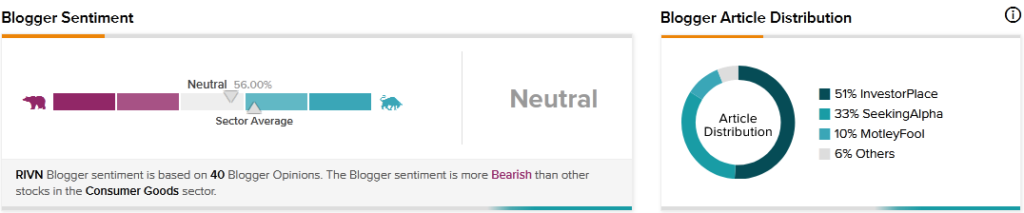

Bloggers Have Neutral Opinions

TipRanks data shows that financial bloggers’ opinions are 56% Neutral on RIVN, compared to a sector average of 63%.

Key Takeaway for Investors

Rivian has started feeling the pressure of the economic downturn amid growing recession concerns. The proposed layoffs should help the company conserve capital awaiting the outlook to improve.

Read the full Disclosure.