Shares of electric vehicles (EV) maker Rivian Automotive (NASDAQ:RIVN) fell after the company announced a $1.3 billion private offering of green convertible notes due 2029 to qualified institutional buyers. This move comes as the company is struggling due to weakening demand amid macro pressures and high costs. RIVN shares fell nearly 6% in Monday’s extended trading session following the news.

Green convertible offerings allow a company to raise capital at a cheaper rate from investors willing to get lower returns in exchange for supporting green projects. Rivian will grant the initial purchasers of the notes an option (for settlement within 13 days from the date the notes are issued) to buy an additional $200 million of the notes. The notes will mature in March 2029 and investors will have the option to convert them into cash or shares in the EV maker during specific periods.

The company disclosed that it intends to use the proceeds from this offering “to finance, refinance, make direct investments in, in whole or in part, one or more new or recently completed (within the 24 months prior to the issue date of the notes), current and/or future eligible green projects.”

A Rivian spokesperson told Reuters that the capital raised through this offering will help launch the company’s smaller R2 vehicle line. The spokesperson added that the convertible debt offering was a better choice due to “optimal cost of capital versus selling equity at today’s levels.”

Rivian held cash and cash equivalents of $11.6 billion at the end of 2022, down from $18.1 billion at the end of 2021. During the Q4 earnings call, the company disclosed that its cash and cash equivalents can fund its operations through 2025.

Is RIVN a Good Buy?

Rivian recently announced mixed fourth-quarter results and 2023 production guidance of 50,000 vehicles that fell short of analysts’ expectation of about 60,000 vehicles. The company produced 24,337 vehicles in 2022.

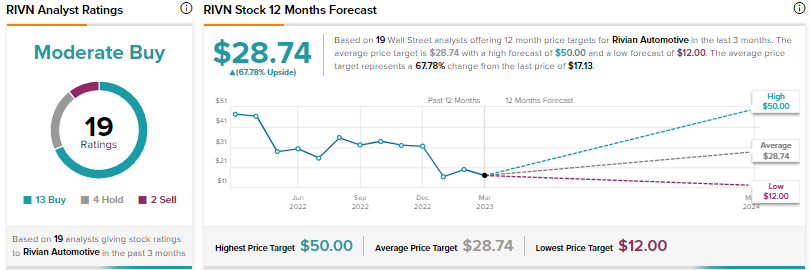

Wall Street’s Moderate Buy consensus rating for Rivian is based on 13 Buys, four Holds, and two Sells. The average RIVN stock price target of $28.74 implies nearly 68% upside potential. Shares are down 7% year-to-date.