American electric vehicle (EV) maker Rivian Automotive (NASDAQ:RIVN) plans to raise $15 billion through a debt issue to fund the construction of its Georgia manufacturing plant. Last month, the company said that it expects to conduct a formal groundbreaking ceremony for the new plant early next year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Debt Issue to Finance New Georgia Plant

Rivian currently manufactures its R1T pickup trucks, R1S SUVs, and electric delivery vans (EDVs) at its manufacturing plant in Normal, Illinois. The company had initially announced its plans to set up its second manufacturing facility in Georgia in 2021 and committed to invest $5 billion. This new facility will have an annual capacity of 400,000 units.

According to a November 9, 2023 agreement, revealed in an SEC filing on Monday, the taxable bonds to finance the construction of the new plant will be issued by the Georgia Department of Economic Development and the Joint Development Authority of Jasper, Morgan, Newton, and Walton Counties. Rivian will purchase the bonds as they are issued.

The company would pay at least about $300 million in property tax payments through 2047. These payments would rise if the EV maker surpasses its $5 billion investment.

After being under pressure due to production setbacks and massive cash burn, Rivian has been taking several measures to streamline its business, reduce its spending, and improve its financials. The company recently reported better-than-expected third-quarter results. It narrowed its adjusted net loss per share to $1.19 from $1.57 in the prior-year quarter. Further, an improved supply chain helped boost the full-year production outlook to 54,000 units from 52,000.

Is Rivian a Buy, Sell, or Hold?

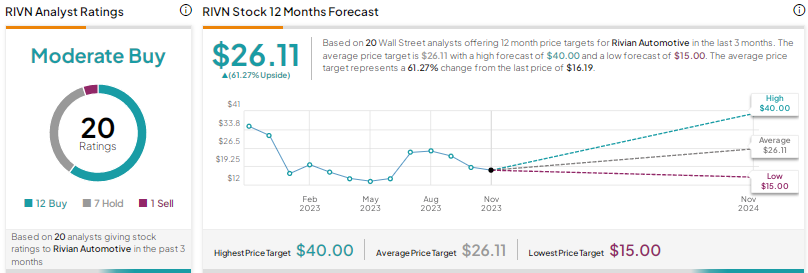

With 12 Buys, seven Holds, and one Sell, Rivian scores Wall Street’s Moderate Buy consensus rating. The average price target of $26.11 implies 61.3% upside potential. Shares are down 12% year-to-date.