Shares of retail drugstore operator Rite Aid (NYSE:RAD) are tanking in the pre-market session today after its second-quarter bottom line came short of estimates.

Revenue dropped 3.4% year-over-year to $5.9 billion, surpassing expectations by $40 million. Net loss per share at $0.63 though, came in wider than estimates by $0.13.

The company took a $252.2 million goodwill impairment charge associated with its Pharmacy Services segment during the quarter.

Looking ahead to fiscal 2023, the company sees revenue landing between $23.6 billion and $24 billion. Net loss per share is anticipated between $1.52 and $0.97.

Is RAD Stock a Buy?

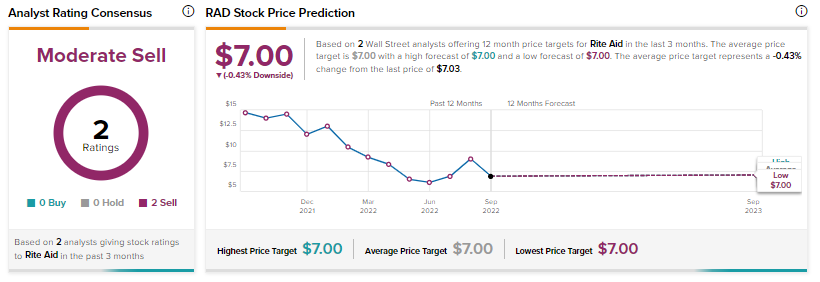

The two analysts covering RAD stock are unanimous in a Sell rating leading to a Moderate Sell consensus rating.

The average price target of $7 implies Rite Aid stock is fairly priced at current levels. That’s after a ~52% share price slide over the past year.

Read full Disclosure