According to a report published by Reuters, EV maker Rivian Automotive, Inc. (NASDAQ: RIVN) has announced an up to 20% hike in the prices of its vehicles due to a rise in component costs and inflation.

The base price of the company’s R1S SUV has increased by around 20%, from $70,000 to $84,500, and almost 17%, to $79,500 from $67,500, for its R1T electric pickup trucks, the company said.

Most of the customers who have pre-ordered the vehicles will have to pay the higher price, it said.

Rivian’s Chief Growth Officer, Jiten Behl, said, “Like most manufacturers, Rivian is being confronted with inflationary pressure, increasing component costs, and unprecedented supply chain shortages and delays for parts (including semiconductor chips).”

The California-based startup also said that the cost of certain options like wheels, paint and reinforced underbody shield have gone up.

The company plans to introduce a model of R1T at the original price of $67,500 in 2024. This model will feature dual motors and a lower-range battery pack.

About Rivian

Rivian designs, develops, manufactures and sells EVs and related accessories. It has a manufacturing plant in Normal, Illinois, and other facilities in Palo Alto, California; Carson, California; Plymouth, Michigan; Vancouver, British Columbia; Wittmann, Arizona; and Woking, England.

RIVN stock closed 8.4% down on Tuesday. It lost another 0.8% in after-hours trading to end the day at $61.44.

Wall Street’s Take

On March 1, Wells Fargo (NYSE: WFC) analyst Colin Langan reiterated a Hold rating on the stock and reduced the price target to $70 from $110 (13.1% upside potential).

The analyst said, “We are bullish on the products and brand strategy; however, we see near-term headwinds.”

Overall, the stock has a Moderate Buy consensus rating based on 11 Buys and 4 Holds. The average RIVN price target of $130.36 implies 110.6% upside potential. Shares have lost 38.5% over the past year.

Website Traffic

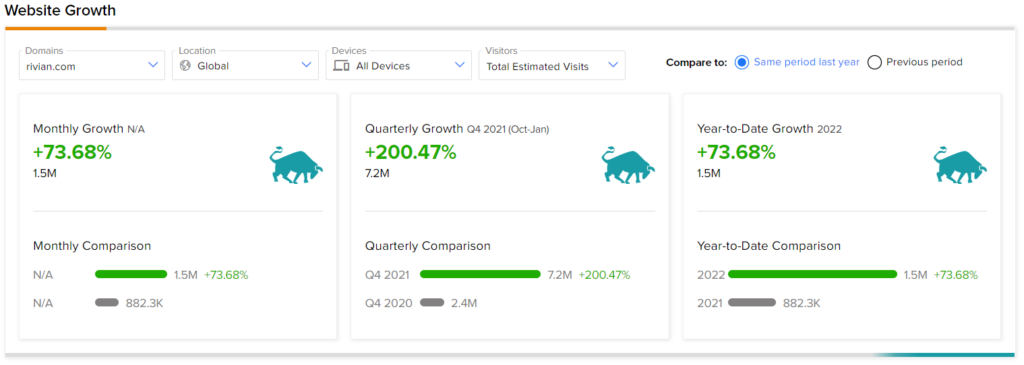

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Rivian’s performance.

According to the tool, compared to the previous year, Rivian’s website traffic registered a 73.7% rise in global visits year-to-date.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Salesforce Reports Upbeat Q4 Results; Street Says Buy

Reata Pharma Gains 25% Despite Q4 Miss

Leidos Bags $11.5B Defense Enclave Services Contract; Shares Jump 3.6%