Redfin shares spiked 11.9% on Feb.19 after the technology-powered real estate brokerage company agreed to snap up RentPath, to make a foray into the home rental market. The Atlanta-based owner of ApartmentGuide.com, Rent.com, and Rentals.com is set to be acquired in a cash deal worth $608 million.

The operational details of the transaction are expected to be released in the near-term. The deal is subject to certain customary closing conditions, which include antitrust approval and approval from a bankruptcy court. RentPath’s rental listings on Redfin.com are expected be integrated in late 2022.

With the acquisition, Redfin (RDFN) will join together a site for buying a home with a site for renting a home, creating more options for individuals seeking a home.

Redfin CEO Glenn Kelman said, “RentPath has more than 20,000 apartment buildings on its rental websites, and grew its traffic more than 25% last year.” (See Redfin stock analysis)

“We can almost double that audience, as one in five of Redfin.com’s 40+ million monthly visitors also wants to see homes for rent. Together with RentPath, we can create an online destination for every North American to find a home,” he added.

Following the deal, Stifel Nicolaus analyst John Egbert reiterated a Hold rating and a price target of $65 (33% downside potential) on the stock. The analyst views “the deal favorably as it effectively broadens Redfin’s suite of real estate services to all U.S. consumers for a reasonable cost for the assets acquired.”

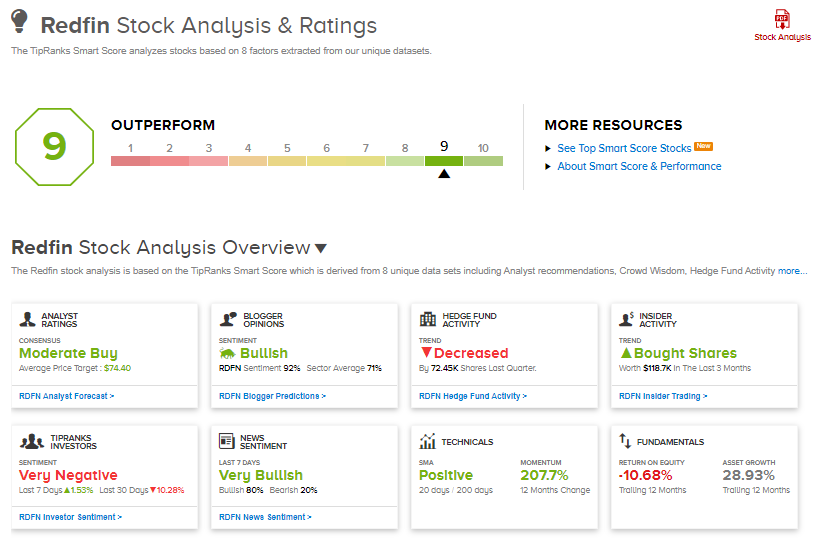

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 3 Buys and 5 Holds. The average analyst price target of $74.40 implies 23% downside potential to current levels. Shares have already jumped almost 41% so far this year.

Redfin scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Match Group Snaps Up Hyperconnect For $1.73B; Shares Gain 2.4%

Shopify’s 4Q Sales Pop 94% As Online Buying Booms; Shares Dip 3.3%

Western Alliance To Buy AmeriHome For $1B; Shares Drop 3.5%