Shares of Range Resources (RRC) fell 5.3% in after-hours trading on Tuesday after the petroleum and natural gas exploration and production company reported revenues that fell massively short of expectations.

Revenues increased 1% year-over-year to $303 million but fell significantly short of consensus estimates of $722.86 million.

Further, adjusted earnings of $0.52 per share fell a cent short of analysts’ expectations of $0.53 per share. The company reported an adjusted loss of $0.05 per share in the prior-year period.

During the quarter, Range Resources reported production that averaged 2.14 billion cubic feet equivalent (Bcfe) per day.

Based on temporary gathering and transportation outages as well as delays due to weather-related events, the company updated its production guidance for 2021. For the full year 2021, the company expects production to average 2.12 to 2.13 Bcfe per day compared to the prior guidance of 2.15 Bcfe per day. Of the expected production, 30% will be attributable to liquids production.

Sharing his views on the future, CEO Jeff Ventura commented, “We expect to generate significant free cash flow in the coming quarters and rapidly approach balance sheet targets with leverage trending below 1x by the end of next year at current strip pricing.”

He further added, “We believe Range is differentiated as a result of our low sustaining capital, competitive cost structure, liquids optionality, marketing strategies, environmental leadership and importantly, our multi-decade core inventory life, which is an increasingly important competitive advantage.” (See RRC stock charts on TipRanks)

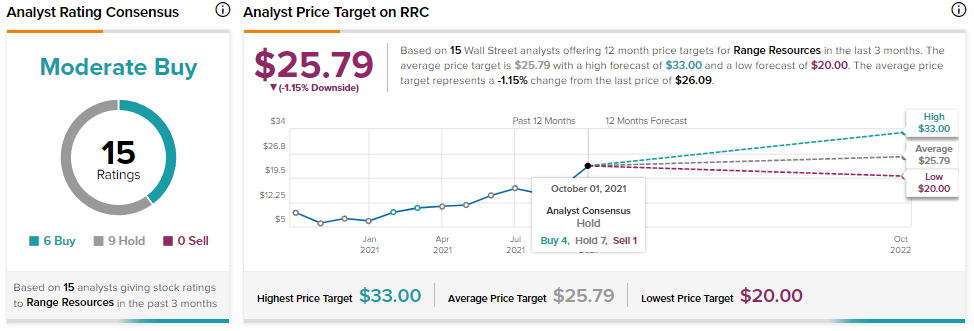

Following the earnings results, Benchmark analyst Subash Chandra initiated coverage on Range Resources with a Buy rating and a price target of $33 (26.5% upside potential).

Chandra forecasts possible “dire shortages” of natural gas and propane in the winter months that could drive prices higher beyond 2022 given supply discipline.

Given the rising commodity prices coupled with lower costs, the analyst believes it’s time for the company’s legacy asset to pay off.

Consensus among analysts is a Moderate Buy based on 5 Buys and 8 Holds. The average Range Resources price target of $27 implies 3.5% downside potential to current levels. Shares of RRC have jumped 202% over the past year.

Related News:

Otis Drops 4.4% Despite Q3 Beat and Improved FY2021 Outlook

Crane Delivers 103% EPS Growth 103% and Boosts FY2021 Outlook

Albany International Posts Q3 Beat and Raises FY2021 Guidance