Shares of Range Resources (RRC) fell 3.1% in pre-market trading on Tuesday after the petroleum and natural gas exploration and production company reported mixed Q2 results.

Revenues of $644.1 million exceeded the consensus estimate of $567.6 million. However, adjusted earnings of $0.24 per share fell short of analysts’ expectations of $0.26 per share. The company reported a loss of $0.10 per share in the prior-year period.

Range Resources reported total production of 2.10 billions of cubic feet equivalent (Bcfe) per day. For the full year 2021, the company expects production to average 2.15 Bcfe per day, which includes 30% attributable to liquids production.

Range Resources CEO Jeff Ventura commented, “Range remains committed to disciplined capital spending and generating sustainable free cash flow and at current strip pricing, we expect Range to rapidly approach our long-term balance sheet targets.” (See RRC stock charts on TipRanks)

He further added, “We believe Range is differentiated as a result of our low sustaining capital, competitive cost structure, marketing strategies, environmental leadership and importantly, our multi-decade core inventory life, which is an increasingly important competitive advantage.”

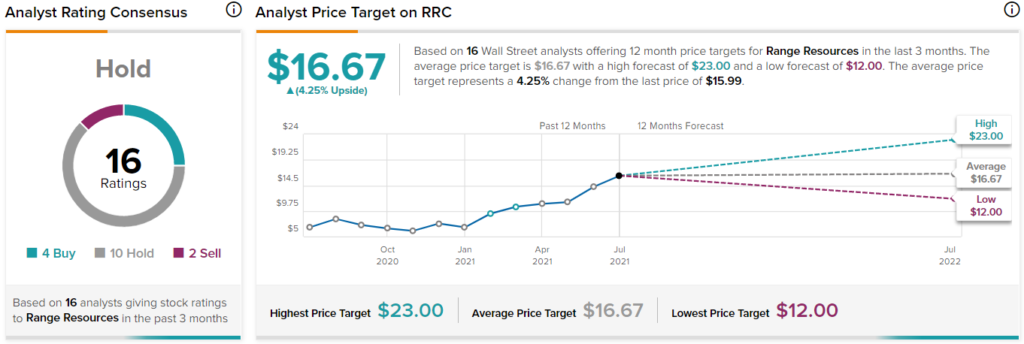

Following the Q2 earnings results, Raymond James analyst John Freeman upgraded Range Resources from Sell to Hold.

Consensus among analysts is a Hold based on 4 Buys, 10 Holds, and 2 Sells. The average Range Resources price target of $16.67 implies 4.3% upside potential to current levels. Shares of RRC have jumped 167% over the past year.

Related News:

NextEra Energy Beats on Q2 Earnings, Expects 6% – 8% Long-Term EPS Growth

First Hawaiian Reports Strong Q2 EPS

Altra Industrial Motion Posts Upbeat Q2 Results, Raises 2021 Guidance