Despite the challenging context, Quebecor (QBR.B) increased its revenues in the first quarter of 2021, helped by gains in its telecommunications business. The Montreal-based company is a leader in telecommunications, entertainment, culture, and news media services.

Quebecor’s revenue for Q1 2021 came in at C$1.09 billion, an increase of 3.4% versus the prior-year quarter. The telecommunications sector posted solid revenue growth of 4.5% to C$914 million. Media revenues were flat at C$174.8 million, while sports and entertainment revenues fell 10.3% to C$31.2 million.

Meanwhile, net income attributable to shareholders fell C$10.3 million to C$121.3 million (C$0.49 per share) during the first three months of the year. Adjusted net earnings amounted to C$0.52 per share, up from C$0.44 per share in the first quarter of 2020. (See Quebecor stock analysis on TipRanks)

Quebecor’s President and CEO Pierre Karl Péladeau said, “Due in large part to Videotron’s solid financial and operational performance, the Corporation increased its EBITDA by 3.7% and its adjusted income from continuing operating activities by 16.5% in the first quarter of 2021. This performance generated a 4.3% growth in our cash flows from operations.”

Videotron’s President and CEO Jean-François Pruneau said, “Offering innovative, effective solutions is at the core of our business model and we continue to successfully roll out our 5G network in Québec. We also continue winning new mobile customers. During the last 12 months, we added 133,400 subscriber connections, partly because of Fizz’s new mobile device offering. We also saw demand growth for our Internet access service, with 74,000 customers added during the period, as well as for our Helix home entertainment and connected lifestyle platform, which has now reached 826,000 RGUs.”

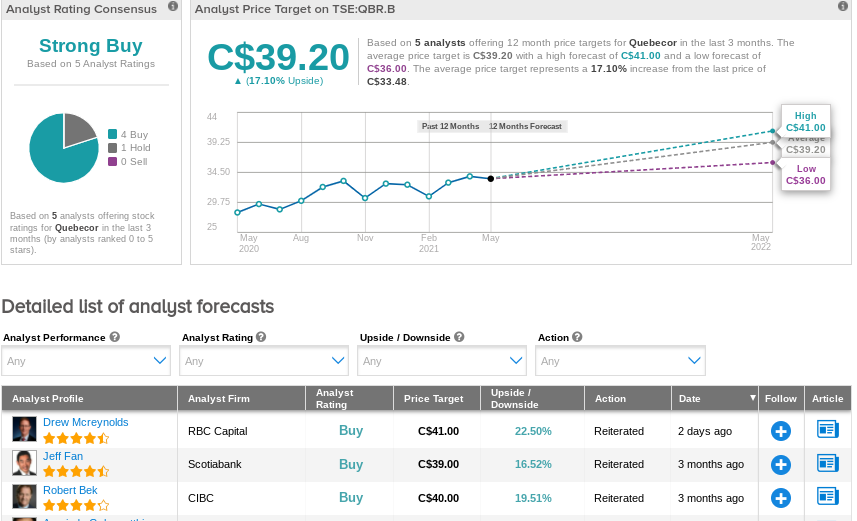

Earlier this week, RBC Capital analyst Drew Mcreynolds reiterated a Buy rating on QBR.B while raising its price target to C$41.00 (from C$39.00) for 22.5% upside potential.

In April, the company announced that Jean-François Pruneau would step down as President and CEO of Videotron in June. He will be replaced by Pierre Karl Péladeau. For McReynolds, this announcement is a “negative surprise”, in particular, because the arrival of Mr. Pruneau at the head of Videotron was relatively recent. The analyst wrote, “We believe that Jean-Francois Pruneau’s track record is highly respected among investors. He had been a key point of contact within the company for over a decade.”

The rest of the Street is bullish on QBR.B with a Strong Buy consensus rating, based on 4 Buys, and 1 Hold. The average analyst price target of C$39.20 implies upside potential of 17% to current levels.

Related News:

Dye & Durham Posts 300% Revenue Growth In 3Q: Shares Jump 6%

TMX Group Posts Better-Than-Expected 1Q Results, Boosts Dividend 10%

Telus Posts Lower 1Q Profit, Raises Quarterly Dividend