Shares of Qualcomm Incorporated (NASDAQ: QCOM) rose more than 6% in the extended trading session on Wednesday after the chipmaker reported upbeat second-quarter Fiscal Year 2022 results. The company also provided a strong outlook for the June quarter.

Both earnings and revenues beat analysts’ expectations driven by the company’s growth and diversification strategy, along with elevated demand for wireless and high-performance, low-power processor technologies across various industries.

Results in Detail

Qualcomm reported adjusted earnings of $3.21 per share, which comfortably beat the consensus estimate of $2.91 per share and grew 69% from adjusted earnings of $1.90 per share reported in the same quarter last year.

Total revenues grew 41% year-over-year to $11.16 billion in the second quarter and surpassed the consensus estimate of $10.6 billion.

Revenues of the Qualcomm CDMA Technologies (QCT) segment stood at $9.5 billion, up 52% year-over-year, fueled by double-digit growth in handsets, RF front-end, automotive, and IoT products. Remarkably, the company’s automotive design win pipeline was more than $16 billion, up over $3 billion on a sequential basis.

However, the Qualcomm Technology Licensing (QTL) segment recorded revenues of $1.6 billion, down 2%.

Capital Deployment

During the reported quarter, the company returned $1.7 billion to stockholders, which included $764 million in cash dividends and repurchases of six million shares of common stock worth $951 million.

Guidance

For the third quarter of Fiscal Year 2022, Qualcomm expects adjusted EPS in the range of $2.75-$2.95, above analysts’ expectations of $2.59. Additionally, total revenues are expected between $10.5 billion and $11.3 billion versus the consensus estimate of $9.99 billion.

QCT revenues are projected in the range of $9.1 billion to $9.6 billion, while QTL revenues are likely to land between $1.4 billion and $1.6 billion.

Official Comments

The CEO of Qualcomm, Cristiano Renno Amon, said, “Demand remains strong across all our technologies and continue to exceed supply. We believe our multi-sourcing and capacity expansion initiatives will continue to provide incremental improvements towards supply throughout the year.”

During the earnings call, the CFO of Qualcomm, Akash Palkhiwala, commented, “We are pleased with our financial results and strong execution as we manage to supply constraints in the current macroeconomic environment. Our QCT handset revenues are on track to grow by greater than 50% in fiscal ’22. And we are well positioned for fiscal ’23 as we continue to benefit from increased processor content and share gains.”

Wall Street’s Take

Following the March quarter results, Mizuho Securities analyst Vijay Rakesh maintained a Buy rating and a price target of $185 (36.94% upside potential) on the stock.

Rakesh believes that the company remains “well-positioned in Auto and RF”.

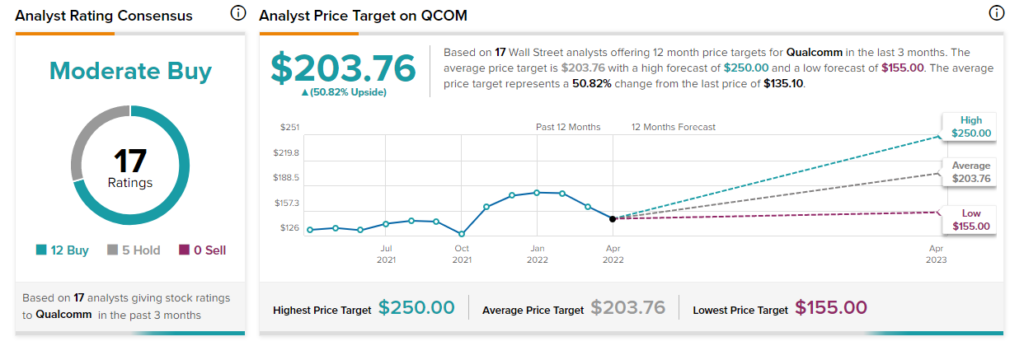

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 12 Buys and five Holds. The average Qualcomm price target of $203.76 implies 50.82% upside potential. Shares have remained almost stable over the past year.

News Sentiment

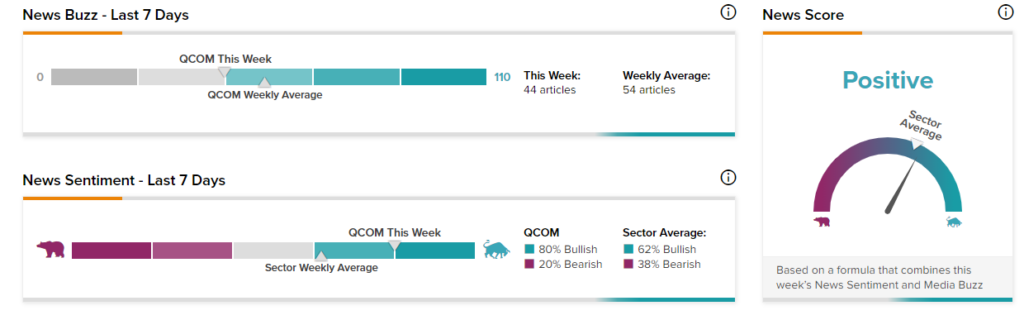

News Sentiment for Qualcomm is currently Positive based on 44 articles over the past seven days. 80% of the articles on QCOM have a Bullish sentiment, compared to a sector average of 62%, while 20% are Bearish, compared to a sector average of 38%.

Ending Words

Strong results, high analyst ratings, a robust outlook, and CEO’s encouraging comments related to demand-supply balance are some of the factors that can be considered before investing in the stock.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Firms Eye Bed Bath & Beyond’s Buybuy Baby Unit; Shares Surge

Twitter & Elon Musk Saga Ends on Definitive Cash Deal Worth $44B

Hawaiian to Kick off In-Flight Internet Services with Starlink