Qualcomm (QCOM) and SSW Partners plan to acquire Veoneer, Inc. for $37 a share. Following the agreement, Veoneer (VNE) called off a previous agreement that could have resulted in it being snapped up by Magna International. QCOM shares fell 1.58% to close at $126.68 on October 4.

Qualcomm is a U.S. company that designs, manufactures, and sells foundational technologies and products used in mobile devices and other wireless products.

Under the terms of the agreement, SSW Partners will acquire all of Veoneer’s outstanding common stock for an equity value of $4.5 billion. Qualcomm will take over the Arriver business as SSW Partners will absorb the Tier 1 Supplier business.

The $37 a share cash purchase price represents an 18% premium to Veoneer’s agreement with Magna. Qualcomm’s and Veoneer’s boards of directors have approved the transaction, expected to close in 2022. (See Qualcomm stock charts on TipRanks)

Qualcomm will absorb the Arriver business, having already worked with it in the past. With the acquisition, the chip giant gains access to valuable assets, including Computer Vision and Driver Assistance, which it plans to merge with Snapdragon Ride. The integration should allow the company to deliver valuable assistance systems to automakers.

Qualcomm CEO Cristiano Amon stated, “By integrating these assets, Qualcomm accelerates its ability to deliver a leading and horizontal ADAS solution as part of its digital chassis platform.”

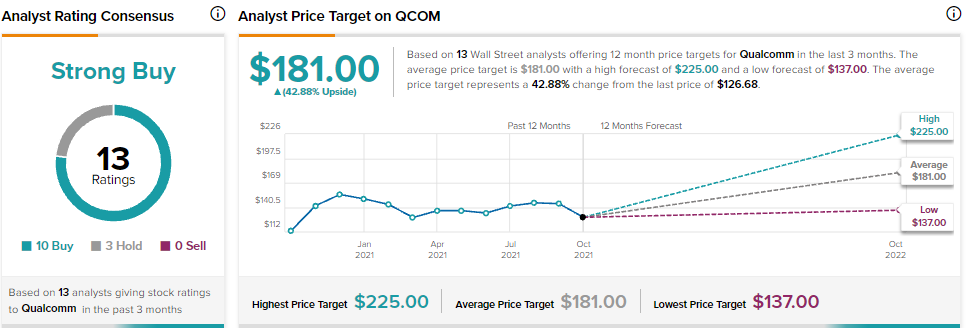

Recently, Jefferies analyst Kyle McNealy reiterated a Hold rating on Qualcomm with a $137 price target, implying 8.15% upside potential to current levels. According to the analyst, the company’s exposure to the maturing handset market could prove to be a challenge. Consequently, its valuation looks appropriate as the operating margin is slightly below the comp group.

Consensus among analysts is a Strong Buy based on 10 Buys and 3 Holds. The average Qualcomm price target of $181 implies 42.88% upside potential to current levels.

Related News:

Scotiabank Commits to Donate C$750K to Connected North

CIBC Run for the Cure Raises Over C$2M

Curaleaf Closes Los Sueños Acquisition; Shares Fall