Shares of storage-as-a-service provider Pure Storage, Inc. (PSTG) are up 69.2% over the past 6 months. PSTG recently delivered better-than-expected third-quarter performance, driven by higher Subscription Services revenue.

During the quarter, revenue increased 37% year-over-year to $562.7 million, beating analysts’ estimates by $31 million. Earnings per share at $0.22 exceeded expectations by $0.10.

The remaining performance obligations of the company increased 27% over the prior year to $1.2 billion.

With these developments in mind, let us take a look at the changes in PSTG’s key risk factors that investors should know.

Risk Factors

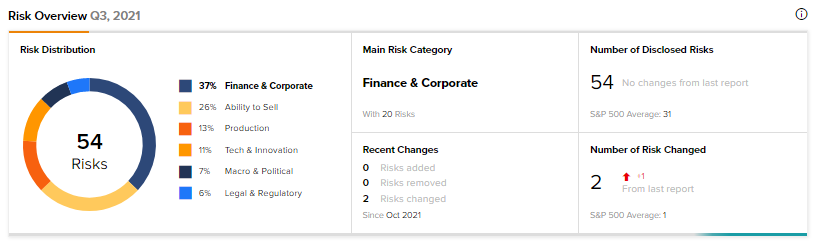

According to the TipRanks Risk Factors tool, PSTG’s top two risk categories are Finance & Corporate and Ability to Sell, contributing 37% and 26% to the total 54 risks identified, respectively. Compared to a sector average of 14%, PSTG’s Ability to Sell risk factor is at 26%.

In its recent quarterly report, the company has changed two key risk factors.

Under the Tech & Innovation risk category, PSTG noted it collects, stores, transits, and processes confidential and sensitive data. The security of its own networks and intrusion protection features of its products are important to PSTG’s operations and business strategy.

(See Insiders’ Hot Stocks on TipRanks)

If PSTG’s security measures fail or an adverse cyber security event occurs, then the company could experience a substantial adverse impact on its business, face damages, litigation, or fines. It may also suffer damage to its reputation in the process.

Wall Street’s Take

On December 14, Evercore ISI analyst Amit Daryanani reiterated a Buy rating on the stock and increased the price target to $40 from $35 (22.8% upside potential).

Consensus on the Street is a Strong Buy based on 14 Buys and 2 Holds for the stock. The average Pure Storage price target of $35.50 implies a potential upside of 8.96%.

Related News:

Pangaea Logistics’ CEO Passes Away; Mark Filanowski Named New CEO

Luminar Technologies Announces $250M Share Repurchase Plan; Shares Jump

Uber Exploring Non-Strategic Asset Sales – Report