Automotive manufacturing giant General Motors Company (NYSE: GM) is steadily increasing the production of its new Hummer electric pickup truck at the Detroit factory, The Wall Street Journal stated in a report.

Shares of the company declined more than 5% to close at $31.76 on Thursday.

With a waiting list of about 77,000 deliveries, the automobile giant has been unusually slow in the production of its vehicles, compared to its peers.

In its revamped Detroit factory, about 700 workers produce around 12 Hummer trucks a day, the Wall Street Journal stated. This is much lower than the 150 F-150 Lightning electric pickup trucks produced per day by Ford (F) and about 2,500 R1T pickup trucks produced by Rivian (RIVN) in the first quarter.

General Motors has cited the development of a new electric-vehicle platform and outsourcing of battery cells as the causes for the slow production. However, the company remarks that the battery problems will be taken care of when a new factory in Ohio, which it developed with LG, will allow the company to source its own battery cells.

At this point in time, General Motors is perhaps taking a gamble with the slower production of its SUVs. However, the company remains confident that the wait will be worth it, as its vehicles will have a longer driving range and faster charging time than its competitors. Further, the company’s new factory for battery cells is also expected to increase the pace of production in the future.

Stock Rating

Recently, Goldman Sachs analyst Mark Delaney reiterated a Buy rating on the stock with a price target of $46, which implies upside potential of 44.8% from current levels.

Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 12 Buys, two Holds and one Sell. GM’s average price target of $58.77 implies that the stock has upside potential of 85% from current levels. Shares have declined 46.3% over the past year.

Website Traffic

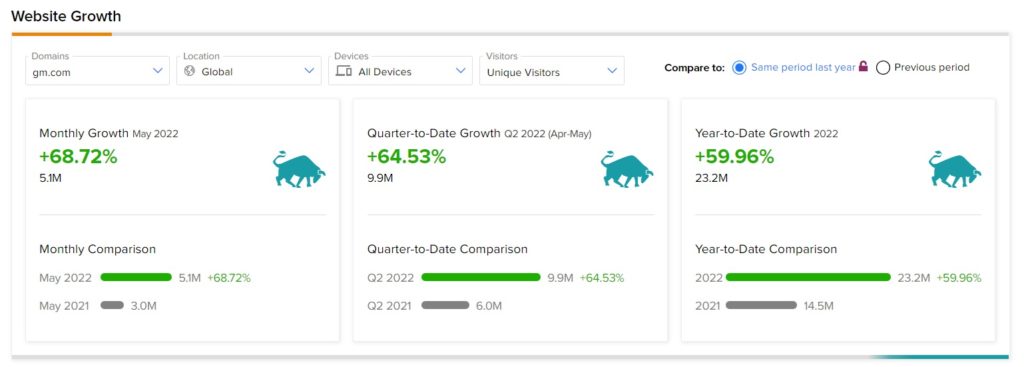

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into General Motors’ performance this quarter.

According to the tool, the General Motors website recorded a 68.72% monthly rise in global visits in May, compared to the same period last year. Further, the footfall on the company’s website has grown 59.96% year-to-date, compared to the previous year.

The company’s impressive website traffic trend hints at the fact that its vehicles are grabbing eyeballs, which can lead to increased sales.

Conclusion

Although the presence of deep-pocketed rivals like Ford and Rivian has resulted in increased competition and a fragmented market, GM’s new battery production facility is likely to help the company gain a strong foothold in the electric vehicle space.

Read full Disclosure