Swimming pool and associated supplies and equipment provider Pool Corporation (POOL) has increased its quarterly dividend by 38% to $0.80 per share.

The dividend is payable on May 28 to shareholders of record on May 17.

Additionally, Pool increased its current share repurchase program by $450 million. The move increases the total authorized share buyback program to $557.4 million.

The company, which is the largest wholesale distributor of swimming pools worldwide, has a presence across North America, Europe and Australia through 400 stores. Pool provides over 200 thousand branded as well as private label products, including swimming pools and associated backyard items. (See Pool stock analysis on TipRanks)

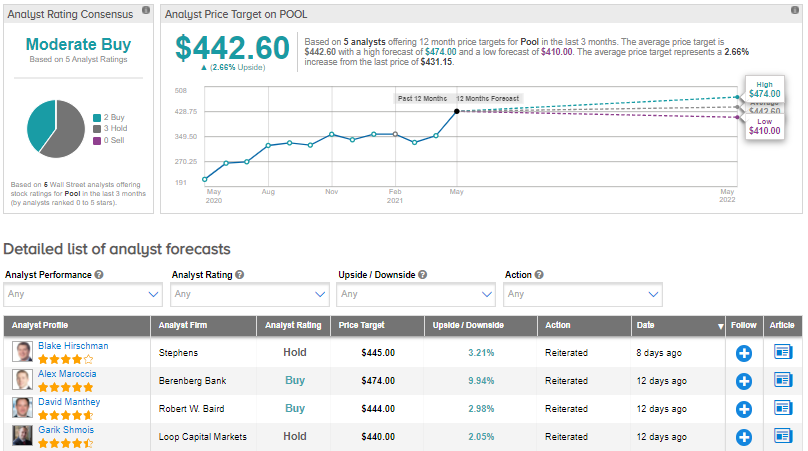

On April 23, Berenberg analyst Alex Maroccia reiterated a Buy rating on the stock and increased the price target to $474 (9.9% upside potential) from $417.

Noting the company’s 1Q results as “exceptional,” Maroccia commented, “Immense operating leverage and cost controls are putting the company on track to be a building materials distribution leader in operating margins.”

Maroccia added that the results show “that the pool industry is still in high demand with no signs of letting up.”

Consensus on the Street is that Pool is a Moderate Buy based on 2 Buys and 3 Holds. The average analyst price target of $442.60 implies the stock is fairly priced at current levels. That’s after a 100.7% gain over the past year.

Related News:

Facebook’s 1Q Results Outperform As Ad Revenue Jumps; Shares Pop 6%

Advanced Micro Devices Posts Better-Than-Expected 1Q Results, 2Q Forecasts Top Estimates

Realty Income Inks Deal To Acquire VEREIT