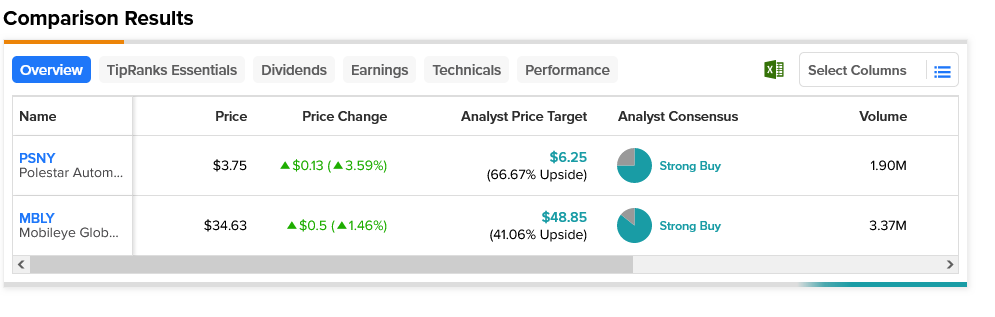

While a disproportionately large amount of attention and investment is flooding into VinFast (NASDAQ:VFS) in the electric vehicle stock space, advances are cropping up all over. Recently, Polestar (NASDAQ:PSLR) and Mobileye (NASDAQ:MBLY) made a deal that sent both up—3..59% and 1.46%, respectively—in the closing minutes of Friday’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So what was the deal that gave both of these a boost? One of the absolute holy grails of driving: autonomous driving systems. The Polestar 4—going on sale in China today and worldwide next year—will feature Mobileye’s SuperVision system, a system that will offer hands-free driving particularly for highway driving. With SuperVision, reports note, users will get access to automatic lane changes, traffic jam assistance functions, adaptive cruise control and collision avoidance. SuperVision runs on the Mobileye EyeQ5 chipset.

But Polestar isn’t stopping there; it also plans to add the Chauffeur system from Mobileye, which will augment the autonomous driving functions still further. Chauffeur adds several functions, including much more complex tools like city driving. However, it also requires an upgrade in the chipset to the EyeQ6 chips, as well as a set of new sensors, including both radar and lidar. While Chauffeur will augment the autonomous driving, it may not work everywhere; Chauffeur works in specific “operational design domains” that may not include everywhere a driver would want to go. Still, this represents a significant advance in autonomous driving, and one that will likely pull new drivers to Polestar.

Both Polestar and Mobileye gained in today’s trading, and both are regarded as excellent additions to a portfolio. Each is rated a Strong Buy by analyst consensus, though each have different upside potentials. Polestar’s average price target of $6.25 gives it a 66.67% upside potential, while Mobileye’s $48.85 average price target gives it a milder 41.06% upside potential.