Plug Power stock swung sharply after unveiling plans to sell electricity rights to AI data centers, a move aimed at shoring up liquidity and reshaping its hydrogen-focused business.

Plug Power Stock Swings as Company Pivots Toward AI Power Deals

Story Highlights

Plug Power’s (PLUG) stock whipsawed Tuesday after the hydrogen firm announced plans to raise cash by selling electricity rights and partnering with AI data centers. PLUG shares swung between $2.93 and $2.36 before closing at $2.53, down 1.2%. The update marked a clear shift for the company, which is now linking its future to the booming demand for AI-driven energy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Plug Tries a New Strategy

The news came after Plug posted third-quarter sales of $177.1 million, slightly above expectations but still far from profitability. Investors focused less on earnings and more on how the company plans to fund itself. Plug burned through $90 million in operating cash during the quarter, ending with $166 million on hand. It raised another $370 million soon after, showing how tight liquidity has become.

To fix that, Plug said it expects $275 million in new liquidity from a mix of asset sales, freed-up cash, and lower maintenance spending. The centerpiece of that plan is selling electricity rights in New York and another location to AI data centers—a move that turns its idle energy assets into quick capital.

Plug Bets on AI Data Centers

Beyond asset sales, Plug aims to partner with data centers that need backup power for massive AI workloads. Using its hydrogen systems, the company wants to supply clean and reliable alternatives to diesel generators. CEO Andy Marsh called the effort a step toward “financial discipline” and a way to expand Plug’s reach into a “dynamic, high-growth market.”

The data center business could be the new start Plug’s been looking for. Big Tech companies are pouring billions into AI infrastructure, and those facilities need stable power. Plug’s ability to deliver backup energy gives it a way to move from one-off equipment sales to longer-term service contracts.

Plug Refocuses and Analysts Take Note

Plug will also suspend its participation in the Department of Energy loan program, choosing to redirect capital toward projects with faster payoffs. The company’s new strategy suggests it is prioritizing flexibility over federal funding.

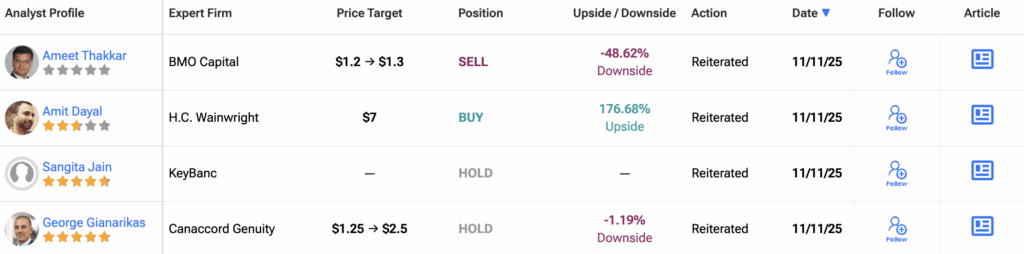

Analysts were mixed but cautiously optimistic. BTIG called the plan “prudent,” while Canaccord said Plug appears to be moving from “build mode” to “harvest mode.” Both firms kept Hold ratings, with Canaccord raising its price target to $2.50. Wall Street still expects Plug to post its first operating profit in 2029, though that timeline may shift depending on how well the new strategy plays out.

Investors Wait for Proof

Plug Power’s stock is up about 20% this year, but remains down 25% over the past month, reflecting a fragile recovery story. Investors want to see results before giving the company credit for its pivot.

If Plug successfully converts its power assets into liquidity and lands data center deals, it could finally move closer to sustainable growth.

Is Plug Power a Good Stock to Buy?

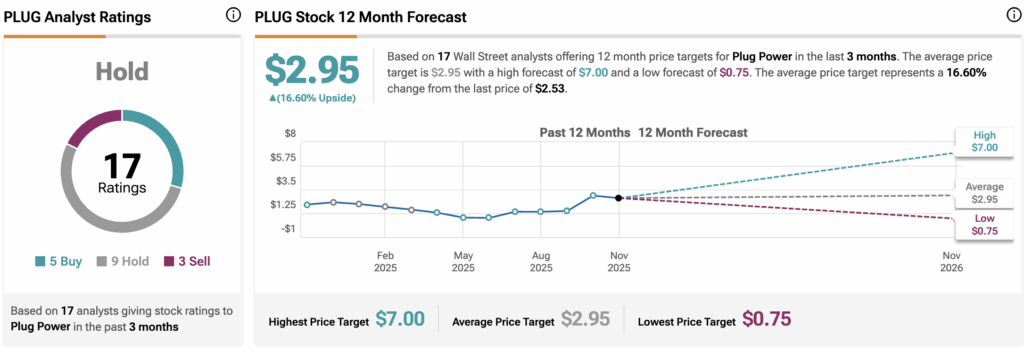

Wall Street remains cautious on Plug Power. Of the 17 analysts covering the stock, most rate it a Hold, with only five recommending a Buy and three calling it a Sell.

The average 12-month PLUG price target sits at $2.95, suggesting a modest 16.6% upside from current levels.

1