Shares of Pinterest rose 31.8% in Wednesday’s extended market trading as the social media company posted robust 3Q financial results. The company’s revenues jumped 58% year-over-year to $443 million and came ahead of the consensus estimate of $377.7 million. Pinterest’s 3Q EPS of $0.13 crushed analysts’ expectations of $0.02 and compared to year-ago earnings of $0.01 per share.

Pinterest’s (PINS) global monthly active users (MAUs) grew 37% year-over-year to 442 million, with the international markets and the U.S. recording year-over-year growth of 46% and 13%, respectively. The ARPU (average revenue per user) spiked 66% to $0.21. Moreover, adjusted EBITDA surged to $93 million in 3Q, compared to $3.9 million in the year-ago quarter.

Pinterest’s CFO Todd Morgenfeld said “The strong momentum our business experienced in July continued throughout the rest of the third quarter. We’re extremely pleased with the broad based strength of our business, driven by recovering advertiser demand as well as positive returns from our investments in advertiser products and international expansion.”

As for 4Q, the company expects revenue growth to be around 60% year-over-year, despite COVID-19 uncertainty. (See PINS stock analysis on TipRanks).

Ahead of the results, on Oct. 26, J.P. Morgan analyst Doug Anmuth raised the stock’s price target to $57 (15.7% upside potential) from $37 but maintained a Hold rating on the stock. The analyst had expected “strong” results with July momentum to continue through Q3 on accelerated marketer demand, ad recovery, and company-specific products and initiatives. Anmuth also had forecast that the slowdown Pinterest suggested for 3Q would prove too conservative.

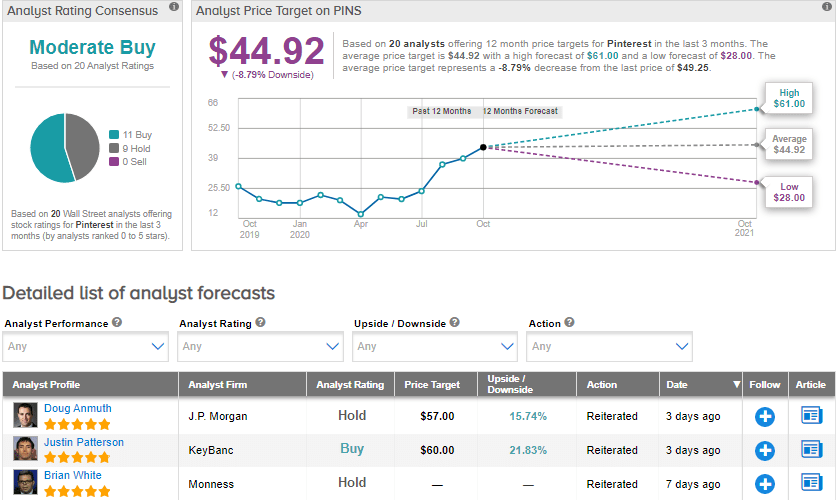

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 11 Buys and 9 Holds. Given the year-to-date share price rally of 164.2%, the average price target of $44.92 implies downside potential of about 8.8% to current levels.

Related News:

Boeing Posts Quarterly Loss As Air Travel Halt Dents Sales; Shares Dip

General Electric Pops 9% As Quarterly Profit Takes Investors By Surprise

Liberty Oilfield’s 3Q Sales Top Estimates As Completions Recover