Pinterest stock (NYSE:PINS) has performed well over the past year. However, its user metrics during this period signal downside potential. While its user base has shown growth, it’s not in high-quality markets. This casts doubt on the idea of sustained revenue growth, which, lately, has been largely driven by favorable market conditions. With Pinterest’s valuation pricing in continuous growth, the possibility of softer financials could lead to a reversal in sentiment. Thus, I am bearish on PINS stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

FY 2023: Decent Results and User Growth for Pinterest…

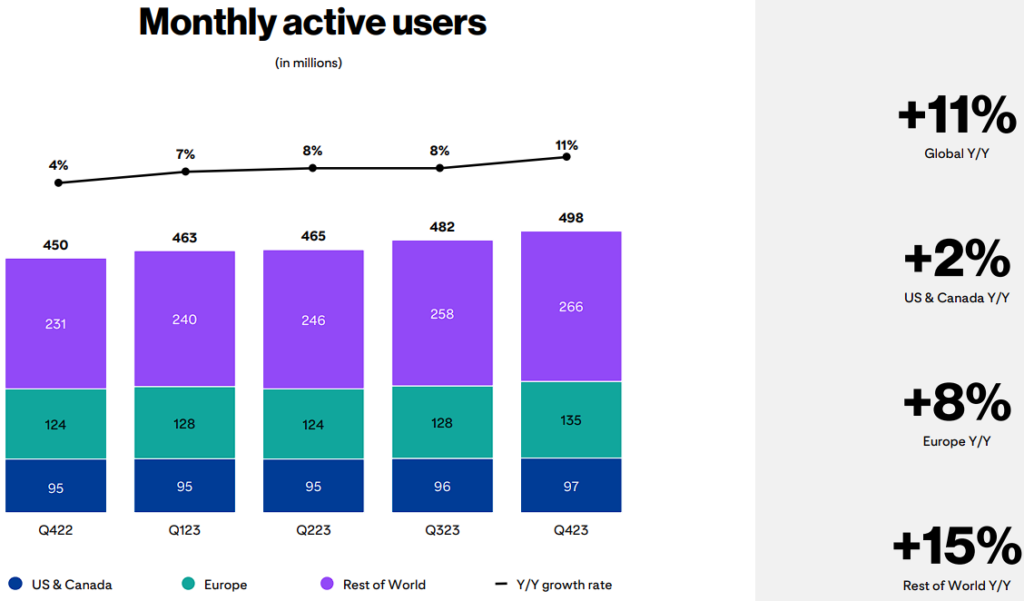

Pinterest sustained decent momentum throughout the past year, with its FY-2023 results celebrating record revenues and noteworthy user growth metrics. Specifically, at the end of the year, monthly active users (MAUs) reached another all-time high of 498 million, representing a year-over-year increase of 11%. It’s also worth mentioning that user growth accelerated both quarter-over-quarter, from Q3’s 8%, and year-over-year, from Q4-2022’s global user growth of 4%.

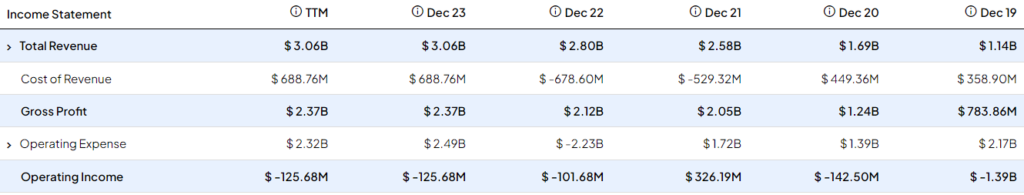

Additionally, driven by a favorable environment in the advertising industry, Pinterest was able to monetize its user base marginally better, with its average revenue per user across all regions growing by 2%. The growth in users and revenue per user resulted in revenues growing by 12% to $981 million in Q4 and by 9% to $3.1 billion for the year. This is in line with the previous year’s growth of 9%, which, to some extent, suggests that Pinterest has “figured it out” in terms of driving sustainable top-line growth.

…But Growth Didn’t Come from Where It Matters

The counterargument to recent optimism, however, is that Pinterest’s user growth doesn’t occur where it matters. This can have a detrimental effect on revenue growth once the advertising market takes a hit. Allow me to explain.

I just mentioned that Pinterest’s user base grew by 11% last year. That said, this was primarily driven by user growth of about 8% in Europe and 15% in the Rest of World (RoW) segment (Globe ex-North America and Europe). In the North America segment (U.S. and Canada), user growth came in at just 2%.

The geographical mix in which Pinterest registers user base growth is important because of the different monetization prospects each region offers. For instance, in North America, Pinterest’s average revenue per user (ARPU) in Q4 came in at $8.07.

In contrast, in Europe and the RoW markets, it came in at $1.23 and $0.15, respectively. In other words, for Pinterest, a single user from North America is worth as much as nearly 54 users from the RoW segment. So, the notable MAU growth in RoW and, to a lesser extent, in Europe isn’t as important as it initially seems.

Furthermore, the geographical growth mix in user growth suggests a potential weakness in ARPU once the advertising industry takes a hit. I believe this argument has substance because the 2% global ARPU growth in last year’s advertising environment is underwhelming in the first place. For context, Meta Platforms’ (NASDAQ:META) ARPU in Q4 grew by 20.8%. Even Snap (NYSE:SNAP), which underperforms consistently, posted ARPU growth of 5% during this period.

This makes me think that Pinterest’s ARPU is highly fragile and could easily dip following a less favorable advertising environment. This is also consistent with the notion that Pinterest is not the go-to platform for advertisers due to its more complicated call-to-action structure. For context, BeProfit, a well-known SaaS platform in the industry, estimated last year that Pinterest’s average return on ad spend (ROAS) stood at 2.7x compared to Facebook’s 10.68x.

Clearly, Pinterest serves as a secondary choice for advertisers, and spending is likely to decline first on this platform if ad budgets see cuts at some point. I believe this risk is significant, as it could easily lead to a re-rating in the stock’s valuation.

The Valuation Doesn’t Take Into Account Any Risk

Based on my earlier argument, Pinterest’s valuation doesn’t seem to take into account any risk related to its user metrics. Wall Street expects that revenues will grow by about 17-18% in Fiscal 2024 and Fiscal 2025, suggesting significant optimism in Pinterest’s ability to drive both user growth and ARPU growth.

In the meantime, EPS is expected to grow by 23.8% in Fiscal 2024 and again by 26.7% in Fiscal 2025. I find these projections to be too optimistic, especially after a year of rather underwhelming North American user growth and global ARPU growth.

With shares currently trading at a forward P/E of 25.4x under optimistic metrics, a dip in revenues due to Pinterest’s fragile ARPU followed by a valuation re-rating could lead to notable downside potential.

Is PINS Stock a Buy, According to Analysts?

Regarding Wall Street’s view on Pinterest, the stock features a Moderate Buy consensus rating based on 21 Buys and nine Holds assigned in the past three months. At $42.90, the average Pinterest stock forecast implies 26.3% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell PINS stock, the most accurate analyst covering the stock (on a one-year timeframe) is Eric Sheridan from Goldman Sachs (NYSE:GS), with an average return of 25% per rating and an 89% success rate. Click on the image below to learn more.

The Takeaway

Overall, I don’t see Pinterest as an attractive investment. Sure, in its latest results, the company celebrated record revenues and accelerated user growth. However, the geographic mix of its user base and weak ARPU growth raises concerns about Pinterest’s prospects for sustained growth.

Further, the overly bullish estimates from Wall Street further heighten these concerns. Should Pinterest’s ARPU indeed prove fragile, particularly in the face of worsening industry conditions, investors may face a downward re-rating in the stock’s valuation.