Pinterest, Inc. (PINS) shares jumped nearly 21.5% during Monday’s extended trading session as investors cheered the company’s second-quarter showing. Notably, metrics from our website traffic tool hinted at the company’s user number dynamics during the quarter

Revenue increased 8.6% year over year to $665.9 million and was in line with the Street’s expectations. Earnings per share (EPS) at $0.11, on the other hand, missed consensus by $0.07. Revenue from the U.S. and Canada grew in single digits, while revenue from the rest of the world jumped 71%. Notably, average revenue per user (ARPU) jumped 17% globally and 80% in the rest of the world geographic segment.

Pinterest CEO, Bill Ready, commented, “We accelerated our investment in shopping and eCommerce this quarter…Pinterest is uniquely positioned to tackle unsolved problems in our industry, capitalize on long-term digital commerce trends, and help people go from inspiration to realization.”

Looking ahead, Pinterest expects a modest mid-single digit gain in the top line and a low double-digit increase in operating expenses for the third quarter.

Elliott Reposes Faith In Ready

The impetus for the rally in Pinterest’s shares came from a positive statement from Elliott Investment Management, which is now the largest investor in the company. Elliott highlighted the growth potential of Pinterest and expressed faith in Bill Ready.

He said, “As the market-leading platform at the intersection of social media, search and commerce, Pinterest occupies a unique position in the advertising and shopping ecosystems, and CEO Bill Ready is the right leader to oversee Pinterest’s next phase of growth. We commend Ben Silbermann and the Board on the leadership transition, and we look forward to continuing our collaborative work with Ben, Bill, and the Board as they drive toward realizing Pinterest’s full potential.”

Analysts’ Take on PINS

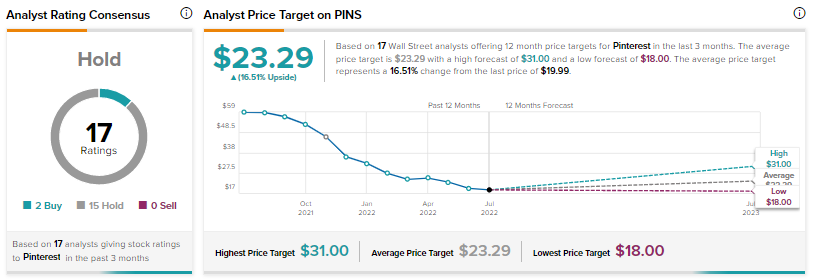

Concurrently, yesterday, RBC Capital’s Brad Erickson reiterated a Hold rating on the stock alongside a $23 price target.

Overall, the Street has a Hold consensus on Pinterest with an average price target of $23.29, implying a 16.51% potential upside. That’s after a nearly 45% slide in the share price so far this year.

Closing Note

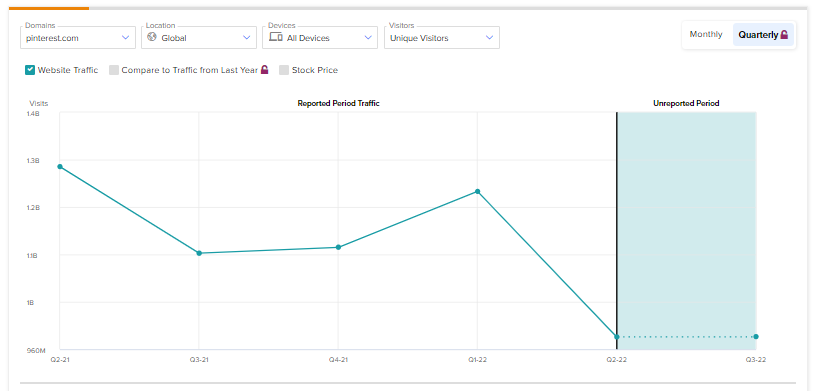

While the statement from Elliott and the expected uptick in Q3 buoyed investor sentiment, global monthly users of the company dropped 5% over the prior year to 443 million. This implies Pinterest needs to maneuver to adapt to audience preferences.

Moreover, this drop in user numbers could also be gleaned from our website traffic tool which indicates total website visits to Pinterest globally and across devices decreased by 20% as compared to the prior quarter.

Learn how Website Traffic can help you research your favorite stocks.

Read full Disclosure