Diversified energy manufacturing and logistics company Phillips 66 (NYSE: PSX) has reported robust results for the quarter ended December 31, 2021. A significant year-over-year rise witnessed in total revenues drove the overall growth for the company.

However, following the earnings, shares of the company reacted in a volatile manner and fell 1.8% on Friday. The stock pared some of its losses in the extended trading session to close at $84.90.

Revenue & Earnings

Phillips 66 reported quarterly revenues of $33.6 billion, which denotes an increase of more than 100% from the same quarter last year. This strong growth in revenues was primarily driven by the 98.7% year-over-year growth witnessed in operating revenues, which also accounted for over 97% of the total revenues of the company.

The company reported quarterly earnings per share (EPS) of $2.88. This compares favorably to the loss per share of $1.23 reported in the previous-year quarter. Further, the figure topped the consensus estimate of $1.69 per share.

CEO Comments

The CEO of Phillips 66, Greg Garland, said, “During 2021, our employees maintained focus on operating excellence, while we delivered record earnings in Midstream, Chemicals, and Marketing and Specialties, and experienced improvement in Refining profitability. Strong cash flow generation allowed us to reinvest in our business, raise the dividend and pay down debt. We continue to focus on returns and disciplined capital allocation. Looking ahead, we are optimistic on economic recovery and the outlook for our businesses.”

Stock Rating

Three days ago, J.P. Morgan analyst Phil Gresh reiterated a Buy rating on the stock with a price target of $98, which implies upside potential of 16.3% from current levels.

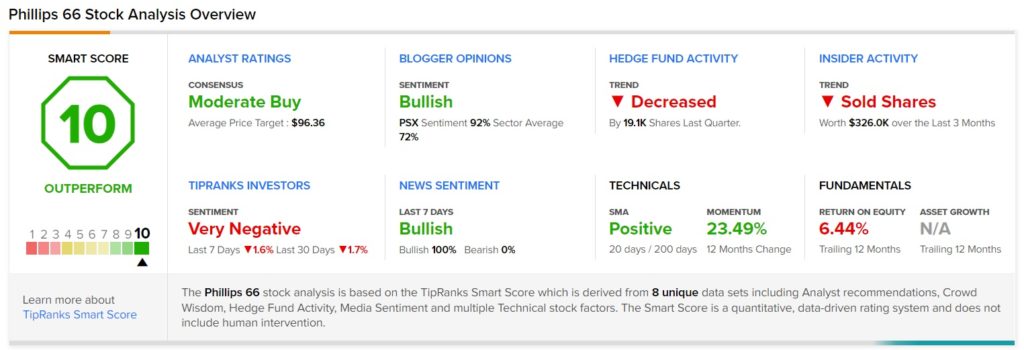

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 8 Buys and 3 Holds. The average Phillips 66 price target of $96.36 implies that the stock has upside potential of 14.4% from current levels. Shares have gained about 25% over the past year.

Smart Score

Phillips 66 scores a “Perfect 10” on TipRanks’ Smart Score rating system. This implies that the stock has strong potential to outperform market expectations, making it one of the best growth stocks for 2022.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

U.S. Steel Sales More than Double in Q4; Shares Up 4.3%

Lowe’s Opens Petco Store-in-Store in Pilot Launch; Shares Rise

SAP to Acquire Taulia