Pfizer has teamed up with LianBio to develop and market a transformative pipeline of innovative therapies and pharmaceutical products in Greater China.

Under the terms of the collaboration, Pfizer (PFE) will invest up to $70 million of non-dilutive capital toward in-licensing and co-development. The US drugmaker also disclosed that it participated in LianBio’s recent crossover financing.

As part of the partnership and at LianBio’s discretion, products will be presented to Pfizer for joint development. Pfizer will have a right of first negotiation to obtain commercial rights to jointly developed drugs and each partner will carry separate financial considerations.

“Pfizer shares a vision with LianBio and their founders, Perceptive Advisors: driving development of and access to best-in-class medical breakthroughs across the China market,” said Pfizer’s Doug Giordano. “Consistent with this vision, our new strategic alliance with LianBio will expand our ability to partner across the biotech ecosystem and enable us to deliver important medical innovations to patients in China.”

It has been an eventful week for Pfizer. The US drugmarker and its German partner BioNTech said that they are planning to apply for US emergency use authorization (EUA) for their COVID-19 vaccine candidate in coming days after the final results from the Phase 3 study showed it to be 95% effective against SARS-CoV-2 infection.

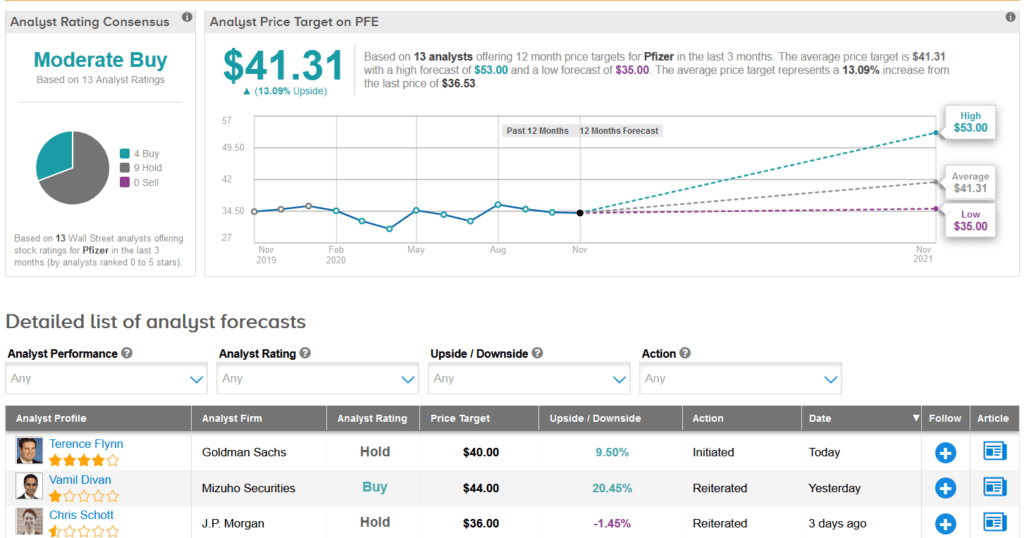

Commenting on the vaccine progress, Mizuho analyst Vamil Divan, who reiterated a Buy rating on the stock with a $44 price target, said that he expects approval and initial administration of the vaccine to high-risk individuals next month.

“We estimate sales of ~ $875M in 2020, ~$7.25Bn in 2021 and then trending down to ~$700M-$800M annually in the outer years of our model. Beyond the numbers, vaccines sales and cash should provide Pfizer with additional options in terms of investing in their business, pursuing acquisition or licensing opportunities, or returning cash to shareholders,” Divan wrote in a note to investors. “The speed with which Pfizer has moved to develop this vaccine candidate is also encouraging to us, and suggests Pfizer may be able to meet its stated objectives of being a faster-moving, more nimble biopharmaceutical company now that the sale of their Upjohn division has been completed.” (See Pfizer stock analysis on TipRanks)

Shares of Pfizer are down 2.2% on a year-to-date basis, and the stock scores a cautiously optimistic Moderate Buy analyst consensus. That’s based on 4 Buys vs 9 Holds. The average analyst price target stands at $41.31, putting the upside potential at 13% over the next 12 months.

Related News:

Pfizer-BioNTech Covid-19 Vaccine Shows 95% Efficacy; Shares Climb

CureVac To Boost Covid-19 Vaccine Production To 300M Doses In 2021

Pfizer Kicks Off Covid-19 Vaccine Pilot Delivery Program In US – Report