Blue-chip pharmaceutical company Pfizer Inc. (PFE) delivered robust fourth quarter and full-year 2021 results with solid sales from its COVID-19 vaccine. The company beat its own guidance of manufacturing more than 3 billion COVID-19 vaccine doses in FY21.

However, shares fell as much as 6.6% during intraday trading, after the company surpassed earnings but failed to meet revenue expectations.

The company also gave an outlook for FY22, which fell short of expectations on both the earnings and revenues front. Shares closed down 2.8% at $51.70 on February 8.

Shares of one of the best coronavirus vaccine stocks, PFE have lost 8% year-to-date while gaining 43.3% over the past year.

Mixed Results

Pfizer reported Q4 adjusted earnings of $1.08 per share, growing a whopping 152% year-over-year, and 20 cents higher than analysts’ estimates of $0.88 per share.

However, quarterly revenues of $23.84 billion missed analysts’ estimates of $24.17 billion. The figure was 105% higher than the year-ago quarter’s $11.63 billion. Revenue growth was impacted due to four fewer selling days in both the U.S. and international markets.

Q4 revenues from Comirnaty (Pfizer-BioNTech SE COVID-19 vaccine) were $12.5 billion and from Paxlovid were $76 million.

For the full year fiscal 2021, adjusted earnings grew 96% to $4.42 per share and revenues came in 95% higher at $81.29 billion. FY21 contribution from Comirnaty was $36.78 billion.

CEO Comments

Chairman and CEO of Pfizer, Dr. Albert Bourla, said, “We are proud to say that we have delivered both the first FDA-authorized vaccine against COVID-19 (with our partner, BioNTech) and the first FDA-authorized oral treatment for COVID-19.”

“I see colleagues who are inspired by what we have achieved to date and filled with determination to be part of the next breakthrough that could change the world for patients in need. As we enter a new year, I look forward to all we will accomplish together,” concluded Dr. Bourla.

FY22 Outlook

Based on the current business momentum, including sales from both Comirnaty and Pfizer’s oral COVID-19 pill Paxlovid, the company gave its full-year fiscal 2022 outlook and also increased guidance from Comirnaty sales.

FY22 revenues are projected to be between $98 billion and $102 billion, much lower than the consensus estimates of $106.5 billion. The revenue guidance includes $32 billion from Comirnaty sales and $22 billion from Paxlovid sales, which include contracts signed as of late January 2022.

Similarly, FY22 adjusted earnings are projected to be between $6.35 per share and $6.55 per share, while the consensus estimate is pegged higher at $6.65 per share.

Analysts’ View

Responding to Pfizer’s mixed financial performance and FY22 guidance, which fell below expectations, Mizuho Securities analyst Vamil Divan, said, “FY22 estimates will likely go up further as we move through 2022 and more contracts are finalized for both Comirnaty and Paxlovid.”

The analyst further stated, “Fundamentally we believe Pfizer remains in a strong position given the success they are experiencing with Comirnaty and Paxlovid, with the key questions being the sustainability of those revenue streams and how the company leverages their “COVID cash” to improve their longer-term outlook.”

Divan reiterated his Hold rating and $56 price target on the Pfizer stock, which implies 8.3% upside potential.

With 9 Buys versus 9 Holds, the stock has a Moderate Buy consensus rating. The average Pfizer price target of $60.13 implies 16.3% upside potential to current levels.

Stock Analysis

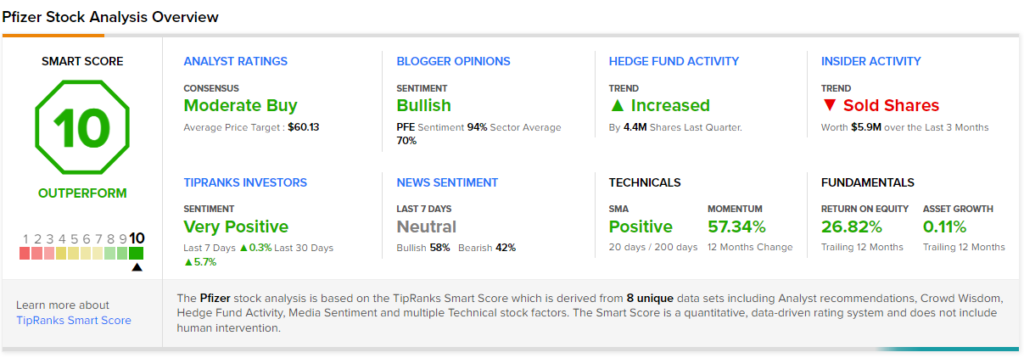

According to TipRanks’ Smart Score, Pfizer scores a “Perfect 10”, indicating that the stock has strong potential to outperform the market. Bloggers are bullish and Investor Sentiment is Very Positive on the stock. Meanwhile, Hedge Funds have increased their holdings of PFE stock by 4.4 million shares and Insiders have sold $5.9 million worth of shares in the last quarter.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Nvidia and SoftBank Terminate Arm Deal Due to Regulatory Pressures

Alibaba Stock Falls 6% as Citi Cautions SoftBank’s Stock Sale – Report

Meta Threatens to Remove FB and Insta from EU Amid Privacy Issues