Snack food and beverage companies have been experiencing increased demand in the at-home channel since COVID-19’s onset. That said, sales in the away-from-home channels took a hit due to travel restrictions, lockdowns, lack of sports events and music concerts as well as other restrictions on public gatherings.

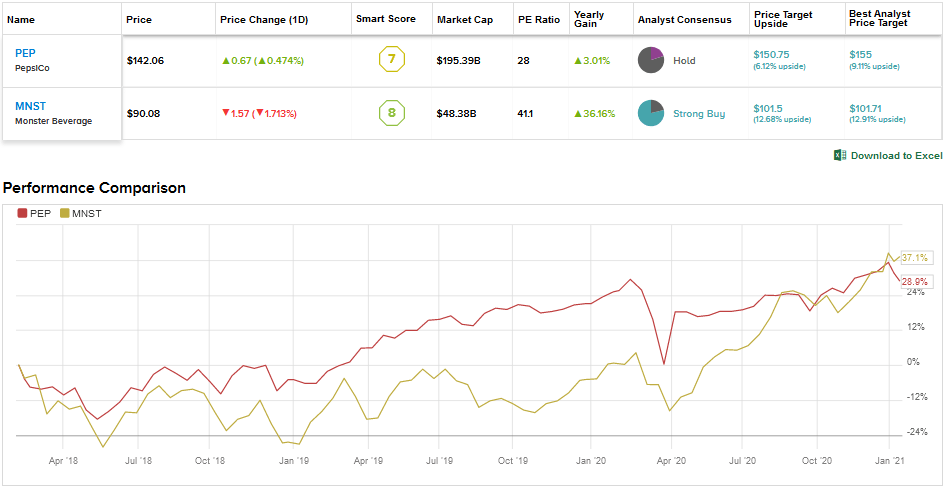

With the rollout of vaccines and the reopening of the economy, demand in the away-from-home channels is expected to improve. But what do Wall Street analysts have to say about major companies in the food and beverage space? Using the TipRanks Stock Comparison tool, we will stack up PepsiCo against Monster Beverage and pick the stock that the Street views as a better choice.

PepsiCo (PEP)

Leading nonalcoholic beverage and snack food giant PepsiCo showed resilience amid the pandemic even as the company’s sales in the away-from-home channels were weak. Notably, the company’s food business displayed greater strength than its beverage offerings.

Both Frito-Lay and Quaker Foods North America segments posted 6% organic revenue growth in 3Q 2020, reflecting higher consumption of brands like Tostitos, Ruffles, Quaker’s pasta, lite snacks and other products.

Meanwhile, organic revenue growth for PepsiCo’s North America Beverages segment came in at 3% as higher pricing offset the impact of lower volumes. Overall, organic volumes of PepsiCo’s food portfolio grew 3% in 3Q and outpaced the 1% rise in global beverage volumes. In recent years, the company’s snack food business has been faring better as the beverage business is under pressure due to weak soda volumes owing to the preference for non-carbonated drinks.

Following its 3Q performance (organic revenue growth of 4.2% and adjusted EPS increase of 6.4%), PepsiCo predicted organic revenue growth of 4% and an adjusted EPS decline of 0.5% for the full-year 2020. (See PEP stock analysis on TipRanks)

Looking ahead, the company continues to innovate and invest in better food and beverage offerings with lower salt and sugar levels. PepsiCo is also expanding its presence in the energy drinks space, which the company referred to as a “highly profitable category” on its 3Q earnings call. Last year, PepsiCo acquired Rockstar Energy for an upfront cash payment of about $3.9 billion, in line with its strategy to grow in the energy drinks market.

PepsiCo, which is a dividend aristocrat (a company that has hiked dividends for at least 25 consecutive years), increased its annualized dividend last year by 7.1% to $4.09 per share. PepsiCo’s dividend yield stands at 2.89%.

Despite certain favorable aspects like a strong snack food business and an impressive dividend track record, PepsiCo was downgraded to Hold by two analysts this month while one analyst initiated a Sell rating.

On Jan. 4, RBC Capital analyst Nik Modi downgraded PepsiCo to Hold from Buy, mainly due to valuation concerns.

The analyst assigned a price target of $153 for PepsiCo stock and stated, “We believe the company will be able to maintain topline momentum via improving consumer insights and stepped up reinvestment. At 24x CY′21E EPS – a half turn away from its 5-yr peak – we are hard pressed to see material share price upside in the absence of material EPS upside.”

The rest of the Street is also sidelined on the stock, with a Hold analyst consensus based on 4 Holds and 1 Sell. The average price target of $150.75 indicates an upside potential of 6.1% from current levels. Shares have essentially been flat over the past one year.

Monster Beverage (MNST)

Monster Beverage is one of the leading players in the global energy drinks market. The company was already facing pressure from rival Red Bull and now the competition is heating up with PepsiCo’s acquisition of Rockstar, the rapid growth of Vital Pharmaceuticals’ Bang energy drink and Coca-Cola’s rollout of Coca-Cola Energy.

Despite the impact of the pandemic on the foot traffic in the convenience and gas channel (which is the company’s largest channel), Monster Beverage’s 3Q net sales grew 9.9% to $1.25 billion and EPS grew 18% year-over-year to $0.65. (See MNST stock analysis on TipRanks)

The company’s growing international presence continues to be a key driver. International net sales increased 17% year-over-year to about $445 million and accounted for close to 36% of 3Q 2020 net sales, up from 34% in 3Q 2019. Under a strategic partnership with Coca-Cola, Monster Beverage has been expanding the distribution of its products in the international markets.

Meanwhile, the company has also been launching several new products, with 3Q introductions including Juice Monster Khaotic Energy + Juice, Juice Monster Papillon Energy + Juice, Monster Energy Ultra Watermelon, Reign Total Body Fuel Lilikoi Lychee and Ultra Energy Peach Mango.

Earlier this month, Stifel Nicolaus analyst Mark Astrachan boosted the price target on Monster Beverage to $105 from $91. The analyst reiterated a Buy rating on the stock given several new product launches anticipated in 1Q 2021.

Commenting on the company’s prospects, Astrachan stated, “Strong sales growth in part reflects successful Fall 2020 innovation (e.g., Ultra Watermelon, juices) with more anticipated in 2021, including the pending launch of Ultra Gold and three Reign SKUs [stock keeping units]. We also anticipate the company to introduce 12-ounce cans for several best-selling SKUs, which could expand usage occasions and also be mix accretive.”

“We also continue to think an alcoholic beverage introduction is increasingly likely in 2021, especially given two additional trademark filings and a job posting for a manager of alcohol strategy, both in late December,” added Astrachan.

Overall, Monster Beverage scores a Strong Buy analyst consensus backed by 11 Buys versus 3 Holds. Shares have gained about 34% over the past year and the average price target of $101.50 implies further upside potential of about 12.7% from current levels.

Conclusion

PepsiCo has an extensive portfolio of brands across the snack food and beverage space. But the dismal soda volumes continue to be a drag while the snack food business is faring well. Currently, Wall Street analysts appear to be more bullish on Monster Beverage’s long-term potential in the high-margin energy drinks space. Also, the stock offers a greater possible upside as indicated by the average price target.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment