PepsiCo’s revenue during the fourth quarter increased 8.8% year-on-year to $22.46 billion, topping analysts’ expectations of $21.78 billion. The beverage company reported diluted earnings per share (EPS) of $1.47, beating the Street consensus by a penny.

During fiscal 2020, PepsiCo’s (PEP) revenue rose to $70.37 billion from $67.16 billion year-on-year. Earnings climbed 2% in constant currency terms to $5.52 per share during the same comparative period. Additionally, the soft drink company ramped up its annual dividend by 5% to $4.30 per share.

Looking ahead to fiscal 2021, PepsiCo forecasted a mid-single-digit increase to organic revenue and a high single-digit increase in earnings in constant currency terms. (See PepsiCo stock analysis on TipRanks)

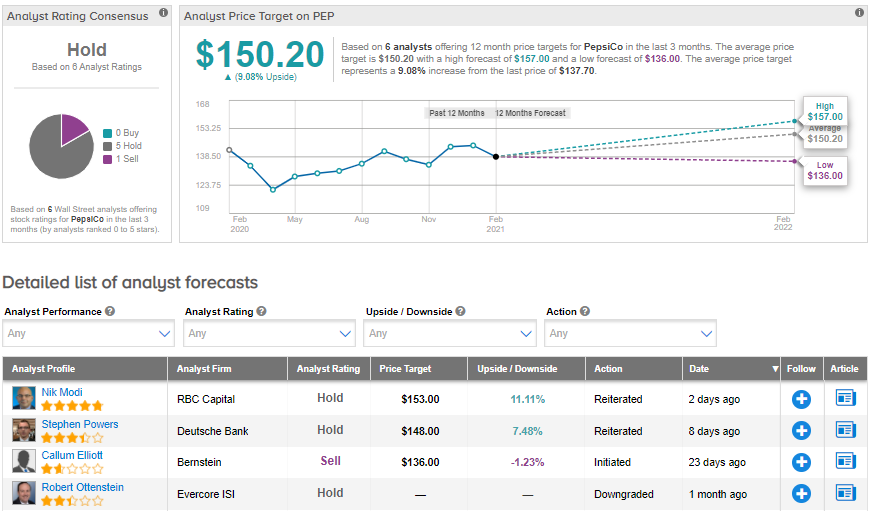

Bernstein analyst Callum Elliott recently initiated coverage on the stock with a Sell rating and a price target of $136 (1.23% downside potential). Callum noted that while the US savory snack market has been growing, PepsiCo profits have not expanded in three years. Furthermore, growth in the company’s snacks vertical has been completely offset by weakness in its beverages business.

The rest of the Street has a Hold consensus rating on the stock. That’s based on 5 Holds versus 1 Sell. The average analyst price target of $150.20 implies about 9% upside potential from current levels.

Related News:

Under Armour Spikes 10% As Quarterly Profit Surprises

Baidu In Talks To Raise Funds For Semiconductor Company – Report

Lyft Sees Recovery Path After 4Q Sales Outperform; Shares Spike 13%