It might be hard to believe that casino stocks like Penn Entertainment (NASDAQ:PENN) are doing so well in a time when even dollar stores are struggling, but the proof is in the numbers. And, of course, in the various calls of analysts. Word from Deutsche Bank was enough to send Penn Entertainment upward nearly 8% in Thursday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Deutsche Bank, via analyst Carlo Santarelli and his team, put out a “catalyst call buy idea” with Penn Entertainment as its focus. It’s a combination of factors driving such a move, starting with its comparatively low share price right now, backed up by some significant new possibilities for growth like ESPN Bet. While ESPN itself is somewhat on the ropes, its name used in connection with sports betting is a solid combination. ESPN Bet will likely be an event to watch over the next several months.

Even as catalysts are kicking in, so too are concerns. The ESPN deal doesn’t come without some risks. First, it’s going to likely take aggressive marketing to get the most out of it, noted one report, and that means extra cash going into marketing. Given the overall slump in the ad market, though, this might be a great time for aggressive marketing as time slots should be cheaper. But this—and factors like it—add up to one key word: uncertainty. Penn Entertainment’s future is hardly assured, especially as consumers pull in their spending.

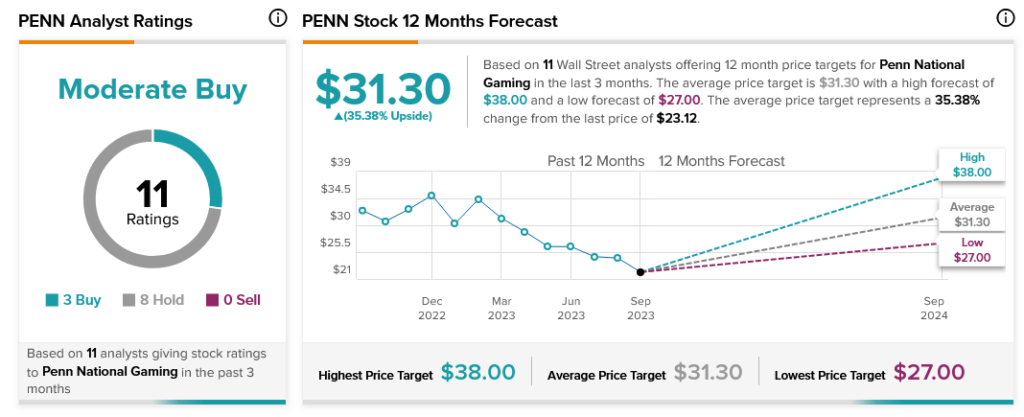

Overall, with three Buy ratings and eight Holds, Penn Entertainment stock is considered a Moderate Buy. Further, with an average price target of $31.30, Penn Entertainment stock comes with 35.38% upside potential.