Peloton stock (NASDAQ: PTON) was down by double digits after the company reported earnings for its fourth quarter of Fiscal Year 2022. Earnings per share came in at $-3.68, which missed analysts’ consensus estimate of -$0.78 per PTON share. In the past nine quarters, the company has beaten estimates 4 times. In addition, sales decreased 28% year-over-year, with revenue hitting $678.7 million compared to $936.9 million. This was below the $718.2 million that analysts were looking for.

This decline in revenue can be attributed to a reduction in consumer demand compared to the pandemic boost.

To make matters worse, the company’s gross profit turned negative. Indeed, the gross margin contracted from 27.1% to -4.4%. The main driver of this was its Connected Fitness segment, which saw a gross margin of -98.1%. Peloton notes that the decline in Connected Fitness was caused by significant increases in inventory reserves, higher logistical and storage expenses, and the recall of its Tread+ product.

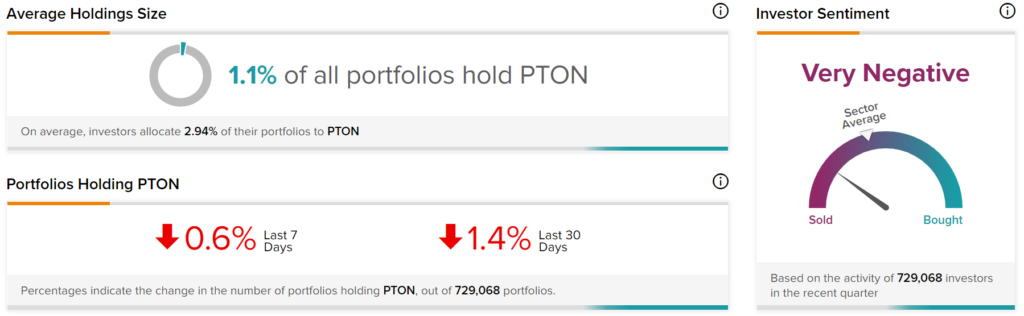

Investor Sentiment for PTON Stock is Currently Very Negative

The sentiment among TipRanks investors is currently very negative. Out of the 729,068 portfolios tracked by TipRanks, 1.1% hold PTON stock. In addition, the average portfolio weighting allocated towards PTON among those who do have a position is 2.92%. This suggests that investors of the company are somewhat confident about its future.

However, in the last 30 days, 1.4% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the following image:

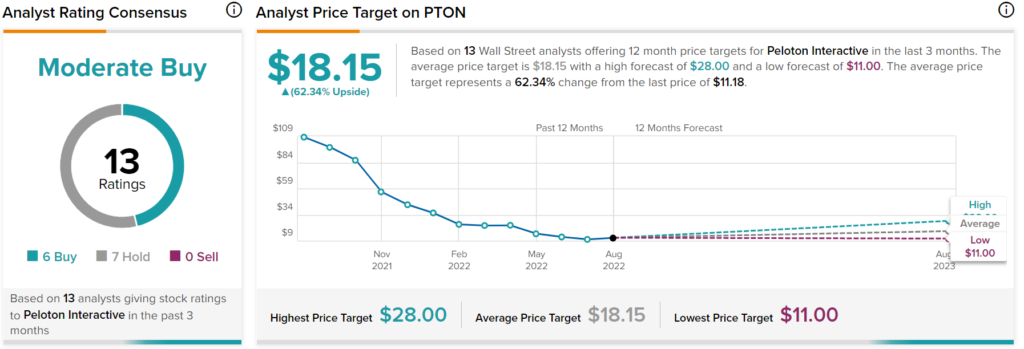

What is the Target Price for PTON Stock?

Peloton has a Moderate Buy consensus rating based on six Buys, seven Holds, and zero Sells assigned in the past three months. The average PTON stock price target of $18.15 implies 62.3% upside potential.

Conclusion: Another Weak Quarter for Peloton, but Bright Spots Exist

Peloton saw another weak quarter as the pandemic darling has been struggling ever since COVID-19 restrictions ended. Nevertheless, it’s worth noting that the company is in the middle of a turnaround plan, and there are a few bright spots. Most notably, subscription revenue was up 36% year-over-year and now accounts for the majority of revenue at 56.4%. In addition, subscription gross margin expanded from 63.3% to 67.9%.

CEO Barry McCarthy believes that subscriptions are the way forward for the company. Thus, it is a good sign to see this segment continue growing. In addition, he expects the company to be cash flow breakeven by the second half of Fiscal Year 2023. Therefore, if McCarthy can execute his vision, then PTON stock may be an interesting play. Nonetheless, there are better opportunities elsewhere.