The COVID-19 pandemic has disrupted several industries. But there are some companies which are thriving amid the current crisis and changing business dynamics. Online pet products seller Chewy, home goods e-commerce retailer Wayfair, online marketplace for creative goods Etsy and at-home fitness equipment maker Peloton Interactive are examples of companies that are witnessing a notable spike in the demand for their products and services during the pandemic.

Keeping in mind the evolving consumer preferences like increased focus on fitness, we will use the TipRanks Stock Comparison tool to place Peloton and athletic apparel maker Lululemon alongside each other and pick the more compelling investment opportunity.

Peloton Interactive (PLTN)

Founded in 2012, Peloton sells technology-enabled fitness products through 103 stores and its e-commerce site. Its revenue has ballooned from $219 million in FY17 to $1.83 billion in FY20 (ended June 30). The company’s product portfolio currently includes the Peloton Bike, Bike+, Peloton Tread and Tread+. It also offers fitness and wellness content to its members through its $39 connected fitness subscription and $12.99 Peloton digital subscription (members cannot access classes through their Peloton bike or tread in the case of Peloton digital).

The pandemic has boosted Peloton’s sales as people are again focusing on health and fitness but are concerned about going back to their gyms due to the rapidly spreading virus. In 1Q FY21 (ended Sept. 30), sales exploded 232% Y/Y to $757.9 million driven by a 274% surge in connected fitness products revenue to $601 million and a 133% increase in subscription revenue to $157 million.

Connected fitness subscriptions jumped 137% to over 1.33 million while paid digital subscriptions climbed 382% to over 510,000. Overall, the company ended the quarter with over 3.6 million members. Thanks to the unprecedented demand, Peloton reported EPS of $0.20 in 1Q FY21 versus a loss per share of $1.29 in 1Q FY20.

Despite the stellar performance, there are concerns about Peloton’s ability to meet the robust demand due to supply constraints. Aside from pandemic-induced demand, the company’s decision to lower the price of its original bike and the success of the newly launched Bike+ have further steepened the demand curve. As per Peloton, product wait times have increased due to port congestion, pandemic-led periodic warehouse closures, west coast forest fires and hurricanes.

Peloton is boosting its manufacturing capacity and increasing the supply of its original bike and bike+ by collaborating with third-party manufacturing partners. Looking ahead, it expects revenue growth of about 114% in 2Q FY21 and full-year as well. Supply chain issues are expected to drag down 2Q margins. (See PLTN stock analysis on TipRanks)

Meanwhile, Peloton is taking various initiatives to grow its high-margin subscription business. It is enhancing its fitness content through attractive additions like the bike bootcamp. In addition, Peloton on Nov. 10 announced a multi-year partnership with iconic artist Beyoncé to offer themed workout content.

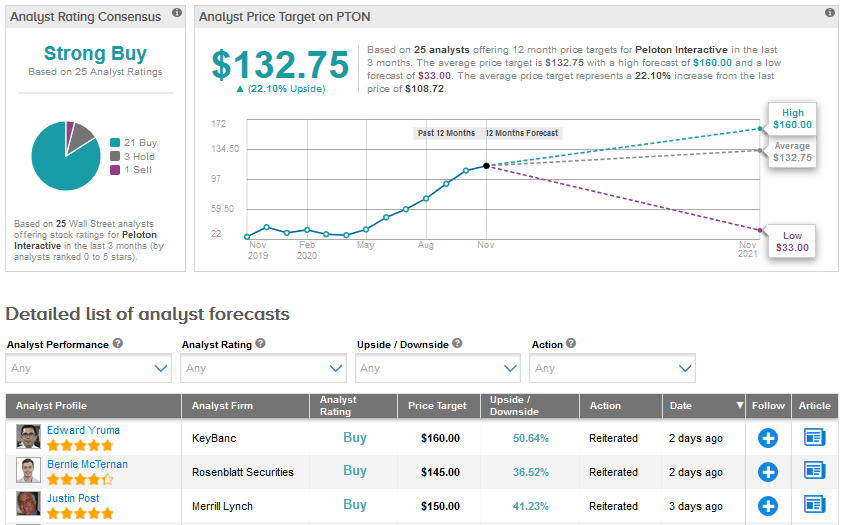

Following this update, KeyBanc analyst Edward Yruma reiterated a Buy rating on the stock with a price target of $160 as he believes that a combination of programming and hardware innovation will expand the total addressable market and differentiate Peloton from other connected fitness competitors. In addition, Yruma believes that accelerating gym closures and bankruptcies also create a more favorable secular outlook despite growth rates slowing against difficult COVID-19 comparisons in 2021.

The analyst added “PTON’s long-term value comes from its compelling and innovative program. A partnership with Beyoncé across multiple fitness categories demonstrates the cultural relevance of Peloton as well as its overall importance to the music industry. We think that content partnerships with the music industry (Featured Artist series) as well as continued programmatic innovation differentiate Peloton from its fitness competitors. “

The rest of the Street echoes Yruma’s bullish sentiment. The Strong Buy analyst consensus is based on 21 Buys, 3 Holds and 1 Sell. Shares have advanced a whopping 282.7% so far this year. Looking ahead, the average price target stands at $132.75, implying further upside potential of 22.1% lies ahead.

Lululemon Athletica (LULU)

Canada-based Lululemon, which started as a yoga-wear maker, has now positioned itself as a strong player in the athletic apparel and accessories space. The company’s revenue grew 21% to about $4 billion in FY19 (ended Feb. 2) despite a highly competitive landscape. However, pandemic-led store closures had a significant impact on the company.

After suffering a 17% sales decline earlier this year in 1Q FY20, Lululemon recovered with 2.2% growth in revenue to $903 million in 2Q FY20 (ended Aug. 2). The company’s direct-to-consumer or e-commerce revenue jumped 155% and helped in offsetting a 51% decline in sales from company-operated stores. The drop in store revenue was due to the lockdown-led temporary store closures and limited operating hours at many reopened locations.

As of the end of 2Q, 492 of 506 company-operated stores were open. Overall, Lululemon’s 2Q adjusted EPS fell 23% Y/Y to $0.74 due to higher expenses, mainly associated with increased e-commerce sales and digital marketing expenses.

Coming to guidance, the company expects 3Q revenue growth in the mid to high single-digit range and 4Q sales growth in the high single to low double-digit range. The company anticipates its adjusted EPS to decline in the 15% to 20% range in 3Q and a modest decline in 4Q.

Meanwhile, under its power of three strategic growth plan, Lululemon continues to focus on innovation, omnichannel capabilities and market expansion. Specifically, the company plans to double its men’s category revenue, double e-commerce sales and quadruple international business by 2023. (See LULU stock analysis on TipRanks)

While several retailers are shutting down stores amid a challenging business environment, Lululemon plans to open 30 to 35 net new stores in the current fiscal year. Also, the company disclosed plans to open about 70 seasonal stores in the second half of the year.

To capture the growing demand for innovative fitness products, Lululemon acquired fitness start-up Mirror for $500 million. Mirror is an in-home fitness platform that streams live fitness classes through its $1,495 wall-mounted mirror device. Subscribers pay Mirror $39 per month to stream the classes. The company expects Mirror to generate revenue of over $150 million in FY20.

Recently, Deutsche Bank analyst Paul Trussell upgraded Lululemon’s rating to Buy from Hold and increased the price target to $396 from $298. The analyst stated, “While valuation is still far from cheap, we believe LULU is positioned to once again outperform the retail sector benefiting from likely being a top consumer destination for Holiday shopping, having a strong margin recovery story over the upcoming quarters, and uniquely having bottom-line support from the balance sheet.”

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus breaks down into 19 Buys vs 8 Holds. With shares up 42.3% year-to-date, the average price target of $385.96 indicates further upside potential of about 17% in the coming 12 months.

Conclusion

Lululemon is well-positioned to capture strong demand in the athleisure space and is building its presence in the fitness world with its Mirror acquisition. But, currently the demand trends appear more favorable for Peloton. Right now, it looks like Peloton stock might be a better pick backed by the Street’s more bullish stance and larger upside potential compared to Lululemon.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment