You have to give exercise equipment maker Peloton (NASDAQ:PTON) some credit. Sure, it wildly overestimated demand after enjoying prominence in the home gym market during the pandemic, but it’s been rapidly trying to find new ways to grow ever since. Those moves haven’t been all that successful so far, but perhaps the new ones will. With Peloton down over 4% in the last minutes of Thursday’s trading day, however, it’s not a sure thing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In aid of that hopeful new growth vector, Peloton launched “Peloton for Business,” a move which is designed to bring “…a unified portfolio of B2B wellbeing solutions for enterprise clients.” Peloton’s planning to launch its program over a wide range of fields, including not only gyms and healthcare operations, but also community and corporate wellness and even multi-family residential operations. Those who get in on the program will get access to a commercial Peloton bike, and can open it up to an unlimited number of users.

Peloton is also looking to branch out into music circles. Realizing that music and workouts tend to go well together, Peloton is sponsoring its own music festival. Dubbed the “Peloton 2023 All for One Music Festival,” it’s already got several names committed to appear, including Skrillex and Katy Perry. Chase credit card holders will also get access to new events, and reports note they’ve sold out rapidly. This is good news, because other reports note that institutional investors are getting fed up with Peloton and considering “drastic measures” in response. With over 75% of Peloton’s stock owned by institutions, that comparatively narrow body could well make or break Peloton’s future.

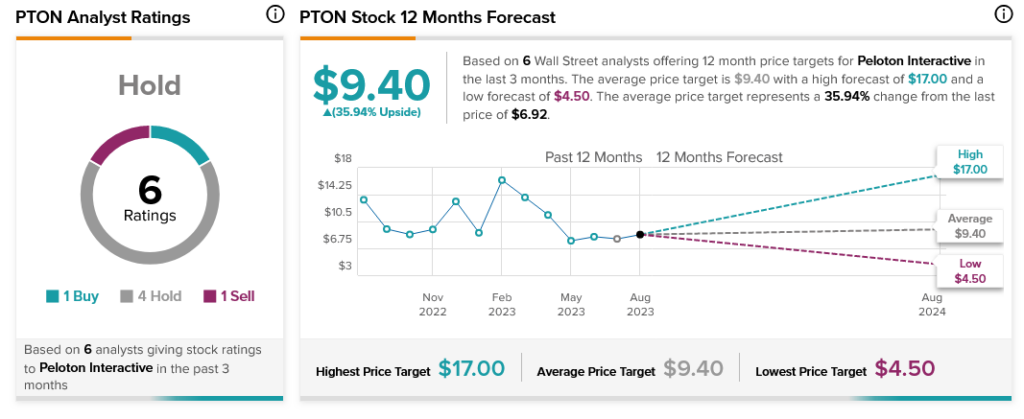

Analysts, meanwhile, aren’t much help. With one Buy rating, one Sell rating, and four Hold ratings, analyst consensus calls Peloton stock a Hold. Further, Peloton stock also comes with a 35.94% upside potential thanks to its average price target of $9.40.