PDD Holdings’ (NASDAQ:PDD) U.S. e-commerce platform, Temu, has taken legal action against its competitor Shein by filing a lawsuit in the federal U.S. District Court for Massachusetts. The lawsuit accuses Shein of violating U.S. anti-trust laws by threatening suppliers to obstruct their partnerships with Temu.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

According to Temu, Shein has taken various actions to hinder competition in the market. These include imposing fines and penalties on suppliers who choose to collaborate with Temu. Additionally, Shein forced about 8,338 manufacturers selling products on its platform to sign loyalty oaths. As a result, the manufacturers were unable to sell products on the Temu Platform.

Temu believes that Shein’s alleged unjust actions have resulted in limited options for consumers along with increased prices within the e-commerce market.

A Brief History of Shein and Temu

Since its entry in the United States in 2017, China-based Shein has managed to capture over 75% of the market share by providing a wide range of trendy items, including shirts and swimsuits, at remarkably affordable prices, some as low as $2. This pricing strategy helped Shein rapidly establish a strong presence in the competitive fast-fashion industry.

On the other hand, PDD’s Temu made its entry into the United States market in late 2022. Temu offers a diverse range of products across various categories, including clothing, jewelry, pet supplies, home and garden items.

Is PDD a Good Stock to Buy?

PDD’s strategy of reinvesting profits to fuel its expansion, strong financials, and building presence keeps Wall Street bullish about its prospects. PDD stock has received nine Buy and two Hold recommendations for a Strong Buy consensus rating. Further, analysts’ 12-month average price target of $107.18 implies 41.6% upside potential from current levels.

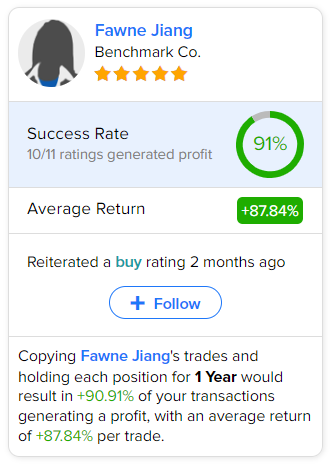

As per TipRanks data, the most accurate and most profitable analyst for PDD is Benchmark Co. analyst Fawne Jiang. Copying the analyst’s trades on this stock and holding each position for one year could result in 91% of your transactions generating a profit, with an average return of 87.824 per trade.