Paysafe (PSFE) delivered upbeat second-quarter revenues after key wins across iGaming and digital commerce verticals such as crypto. However, shares of the payments company closed 15.49% lower on Monday.

Revenue was up 13% year-over-year to $384.3 million, above the consensus estimate of $378.45 million. The increase affirms the impact of actions taken to bolster its risk/reward profile in certain markets and channels. Additionally, total payment volume was up 41% from the same quarter last year to $32.3 billion. (See Paysafe stock charts on TipRanks)

In other positive news, adjusted EBITDA increased 8% from the same quarter last year to $118.8 million. However, the adjusted EBITDA margin was down 150 basis points (bps) to 30.9%, reflecting business mix, which included headwinds from the high-margin direct marketing vertical.

Paysafe is currently working on its cost-saving program. The company has achieved $17 million in cost savings and is now targeting $30 million before year-end. It is also working on the acquisitions of PagoEfectivo and SafetyPay, as it seeks to create the largest open banking solution in Latin America.

Paysafe CEO Philip McHugh stated, “In total, we remain confident in our 2021 outlook and the years ahead as we continue to see the combination of our eCommerce gateway, digital wallets, online banking, and eCash solutions as a true differentiator in the market.”

Paysafe expects revenue of between $360 million and $375 million for the third quarter, with adjusted EBITDA of between $95 million and $110 million.

For the full year, revenue is projected between $1.53 billion and $1.55 billion, and adjusted EBITDA is expected to be in the range of $480 million to $495 million.

Recently, Bank of America Securities analyst Jason Kupferberg reiterated a Buy rating on the stock with a $15 price target, implying 74.01 % upside potential to current levels.

The analyst expects the company to capitalize on the rapidly growing U.S. iGaming market, backed by a proven go-to-market playbook.

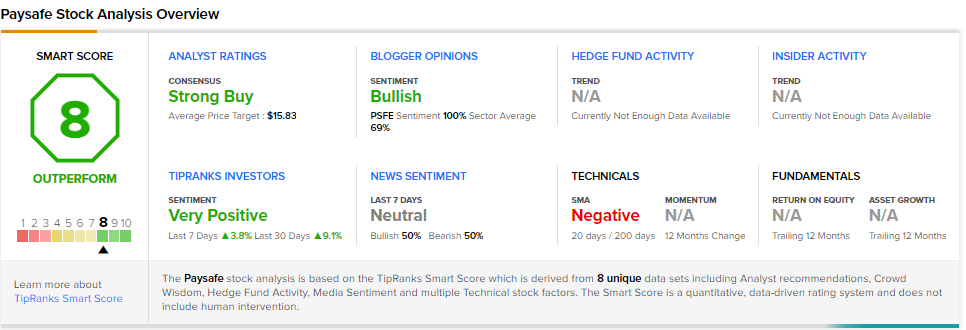

Consensus among analysts is a Strong Buy based on 6 unanimous Buys. The average Paysafe price target of $15.50 implies 79.8% upside potential to current levels.

PSFE scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Registration Opens for RBC Race for the Kids

Village Farms Buys CBD Leader Balanced Health Botanicals

HLS Therapeutics to Promote Pfizer’s Vascepa in Canada