Shares of Paychex, Inc. (NASDAQ: PAYX) declined 4.2% on Wednesday even though the company posted upbeat results for the fourth quarter of Fiscal 2022 (ended May 31, 2022). The fall in the stock price seems to reflect the market’s resentment over the company’s weak projections for Fiscal 2023 (ending May 2023).

It is worth mentioning here that the adjusted earnings of this $41.5-billion provider of human capital management (HCM) solutions surpassed the consensus estimate by 1.3% in the fourth quarter. Meanwhile, its sales surprise in the quarter was 2.7%.

Quarterly Highlights

In the quarter, Paychex’s adjusted earnings stood at $0.81 per share, higher than the consensus estimate of $0.80 per share. Also, the bottom line increased 13% from the year-ago tally of $0.72 per share, driven by higher revenues. High costs and expenses played spoilsport in the quarter.

Revenues in the quarter were $1.14 billion, up from the consensus estimate of $1.11 billion. On a year-over-year basis, the top line increased 11% on the back of an 11% surge in service revenues and a 2% rise in interest on funds held for clients.

The company’s service revenues in the quarter were $1.13 billion, including management solutions sales of $0.85 billion, and professional employer organization (PEO) and insurance solutions sales of $0.28 billion.

The cost of service revenue grew 14% year-over-year to $360 million, while selling, general and administrative expenses advanced 9% to $390.3 million. The adjusted operating income in the quarter was $394 million, up 11% year-over-year.

Annual Highlights

In the year, Paychex’s revenues were at $4.61 billion, up 14% from the previous year. The adjusted earnings were $3.77 per share in the year, reflecting a 24% increase from $3.04 per share a year ago.

Exiting the year, the company’s cash and cash equivalents stood at $370 million, down 62.8% from the previous year. Long-term debts remained nearly unchanged at $797.7 million.

The net cash flow from operating activities in the year increased 19.5% year-over-year to $1,505.5 million. The company’s spending on property and equipment totaled $132.6 million, up 15.7% from the previous year.

Projections

For Fiscal 2023 (ending May 2023), Paychex anticipates revenues to increase 7%-8% year-over-year. This projection is lower than 14% revenue growth in Fiscal 2022.

The company expects management solutions sales to increase 5%-7%, and PEO and insurance solutions sales to expand 8%-10%. Interest on funds held for clients is forecast to be within the $85-$95 million range.

Further, the company expects the adjusted earnings per share to expand within the 9%-10% range in the year. This is below the 24% growth recorded in Fiscal 2022.

Official Comments

Paychex’s Chairman and CEO, Martin Mucci, said “…we provide employers with the digital tools and the HR expertise to hire, engage, train, and retain top talent in this challenging environment.”

“Our purpose remains to help small- and mid-sized businesses succeed, and we believe we are well-positioned to continue to deliver on that mission in the upcoming fiscal year,” Mucci added.

Capital Deployment

In Fiscal 2022, Paychex used $999.6 million (up 10% year-over-year) for dividend payments and $145.2 million (down 6.7%) to buy back 1.2 million shares.

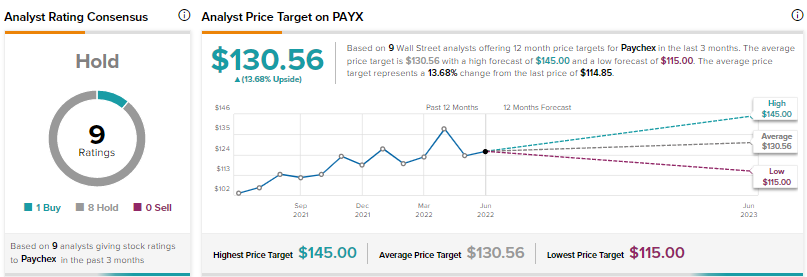

Stock Rating

As per TipRanks, Paychex has a Hold consensus rating based on one Buy and eight Holds. PAYX’s average price forecast of $130.56 suggests 13.68% upside potential from the current level. Over the past year, shares of PAYX have increased 7%.

On Wednesday, Jason Kupferberg of Bank of America maintained a Neutral rating on PAYX while lowering the price target to $124 (7.97% upside potential) from $138.

Risks Analysis

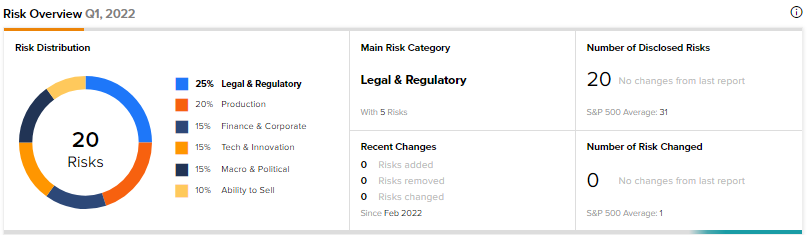

According to TipRanks, Paychex’s top two risk categories are Legal & Regulatory and Production. While the Legal & Regulatory risk category adds five risks to the total 20 risks identified for the stock, the Production risk category accounts for four risks.

Conclusion

Paychex has benefited from the growth in service revenues in the fourth quarter of Fiscal 2022. However, high costs and expenses might raise concerns in the quarters ahead. The company’s projections signal a slow pace of growth in Fiscal 2023.

Read full Disclosure