Shares of pizza chain Papa John’s International (PZZA) buzzed with excitement on Monday, trading over 12% higher around 1:51 p.m. EDT.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This comes as media reports indicated a buyout offer from New York-based private equity firm TriArtisan Capital was on the table. The rumored intention follows alternative asset manager Apollo’s (APO) withdrawal of its acquisition offer last week — a move that sent Papa John’s shares plunging.

Is a New Acquisition Offer on the Table?

In early October, Apollo offered to take the longstanding pizza business private at $64 per share, after initially seeking to make the move alongside Irth Capital Management.

However, a consortium led by TriArtisan is now looking to take over the business in a $65-per-share deal, ABC Money reported, citing insider sources. Seeking Alpha dismissed the report as untrue, also citing people familiar with the matter.

During the first hours of trading on Monday, PZZA stock jumped as high as 13% on the news, forcing trading in the shares to be halted before it later resumed.

Is ‘Another Chapter’ Coming for Papa John’s?

Reacting to the news, investment firm Stephens noted that the “fresh takeover chatter” indicated “another chapter in the PZZA acquisition saga.”

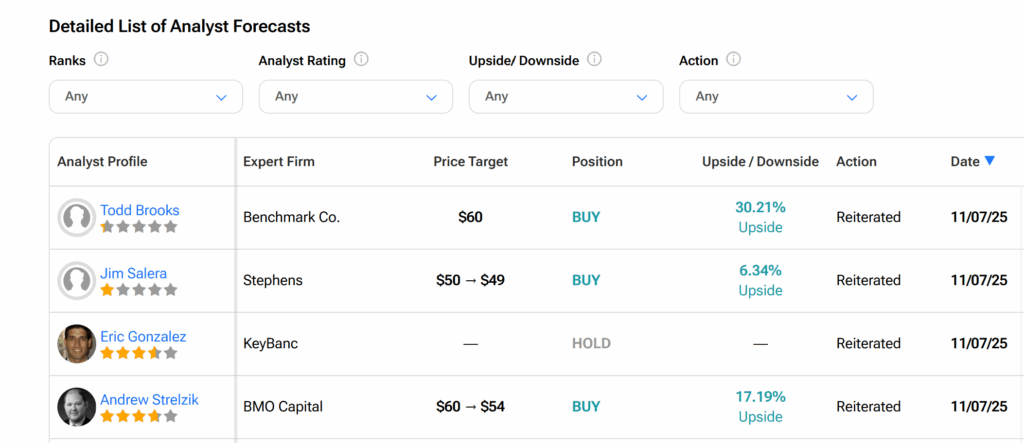

According to Stephens, news of the possible acquisition of the struggling pizza chain has helped to prop up PZZA stock throughout this year. The investment firm maintains its Overweight (Buy) rating on PZZA stock with a price target of $49 that comes with about 8% upside.

The reports of a new buyout offer come days after Papa John’s third-quarter Fiscal Year 2025 results showed uneven performance. While its global comparable sales — sales from restaurants that have been open for at least a year — rose 2% from a year ago, sales in North America fell 3%. Ultimately, its overall revenue came in flat in the quarter.

Meanwhile, during its second quarter, Papa John’s profits plunged 23% to $10 million. In its third quarter, profits collapsed 91% to $4 million. However, this was attributed to the lack of a one-time gain from property sales seen during the quarter in the previous year.

The company opened 45 new restaurants during its recent quarter.

Is PZZA Stock a Good Buy?

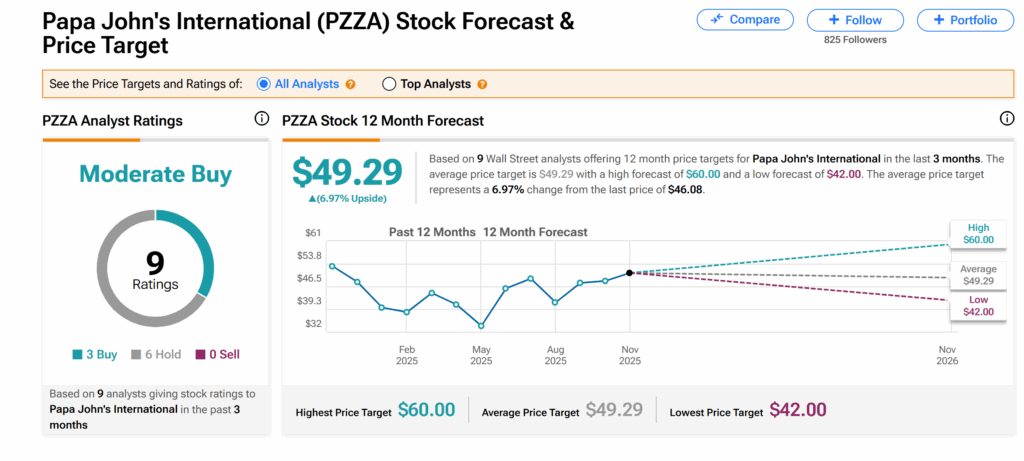

Across Wall Street, Papa John’s shares currently have a Moderate Buy consensus rating based on three Buys and six Holds issued by nine analysts over the past three months.

At $49.29, the average PZZA price target suggests about 7% upside from the current trading level.