Palo Alto Networks, Inc. (PANW) reported Q3 revenue of $1.07 billion, up 24% from the year-ago period and surpassing Street estimates of $1.06 billion. Shares of the company popped 6% in the extended trading session on May 20.

Palo Alto Networks is a global cybersecurity company providing network security solutions to enterprises, service providers, and government entities.

Earnings for the third quarter stood at $1.38 per share, up 18% year-over-year, and beat the Streets estimates of $1.28 per share. (See Palo Alto Networks stock analysis on TipRanks)

Billings for the quarter grew 27% to $1.3 billion and deferred revenue grew 30% to $4.4 billion, compared to the same quarter last year. The Billings metric used by the company is defined as total revenue plus the change in total deferred revenue, net of acquired deferred revenue.

Commenting on the Q3 results, Nikesh Arora, chairman, and CEO of the company said, “The work-from-home shift earlier in the year and recent cybersecurity issues have increased the focus on security. Coupled with good execution, this has driven great strength across our business… We are pleased to be raising our guidance for fiscal year 2021 as we see these trends continuing into our fiscal fourth quarter, bolstering our confidence in our pipeline.”

In Q4, the company forecasts revenue to be in the range of $1.16 billion to $1.17 billion, compared to a consensus of $1.16 billion and it expects billings of between $1.69 billion and $1.71 billion. EPS is expected to be in the range of $1.42 and $1.44, compared to consensus estimates of $1.42 per share.

For the fiscal year 2021, the company forecasts revenue to be in the range of $4.20 billion to $4.21 billion, compared to consensus estimates of $4.18 billion, and billings are expected to come in between $5.28 billion and $5.30 billion. EPS is expected to be in the range of $5.97 to $5.99, compared to a consensus of $5.88 per share.

Jefferies analyst Brent Thill maintained a Buy rating on the stock and lowered the price target to $400 from $460, which implies 16.8% upside potential from current levels.

Thill believes software valuations are “taking a breather post their massive run” from the previous year and has cut price targets for 70% of software companies covered by him, accounting for multiple compression in the space. But the analyst believes in the group’s strong fundamentals, and he continues to remain positive on its long-term potential.

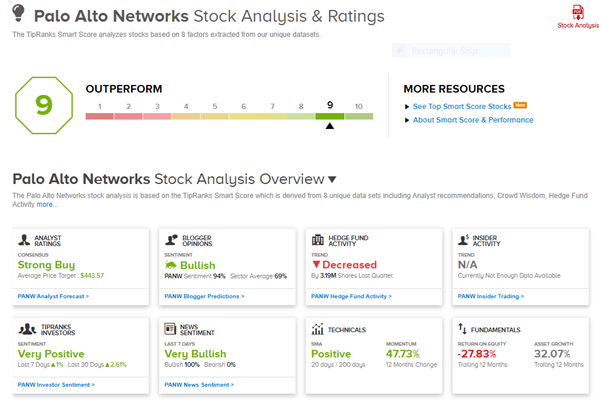

Consensus among analysts is a Strong Buy based on 22 unanimous Buys. The average analyst price target stands at $443.57, which implies upside potential of 29.5% to current levels. Shares have gained 15.7% in the last six months.

Palo Alto Networks scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Heroux-Devtek Q4 Sales Decline 7%; Shares Jump 8%

ATS Automation Beats on Revenue, Miss on EPS in Q4; Shares Gain 8%

Aurora Cannabis and Grow Group Extend Partnership