Data analytics firm, Palantir Technologies, impressed with its 3Q sales performance amid strong demand for its software. The company’s 3Q revenues jumped 52% to $289.4 million year-over-year, surpassing analysts’ expectations of $279.1 million.

Palantir (PLTR) said that “The demand for our software has increased steadily over the past year in the face of significant economic and geopolitical uncertainty in the United States and abroad.” During the quarter, the company won 15 deals with a contract value of $5 million or more.

Despite strong top-line growth, Palantir’s loss per share of $0.94 widened from the year-ago quarter’s loss of $0.24 due to stock-based compensation expenses related to the company’s stock exchange listing in September. (See PLTR stock analysis on TipRanks).

Meanwhile, Palantir raised its full-year sales outlook. The company now forecasts 2020 revenues of $1.072 billion, up from $1.07 billion previously. For 4Q, it projects revenues between $299 million and $301 million.

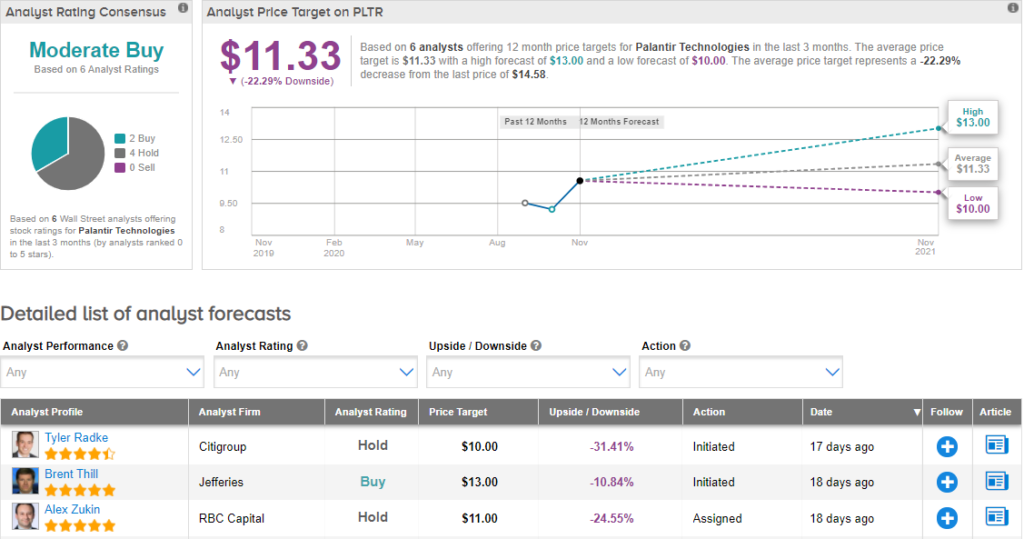

Last month, Citigroup analyst Tyler Radke initiated Palantir coverage with a Hold rating and price target of $10 (31.4% downside potential). In a note to investors, Radke said that he is concerned about the company’s scalability and “market fit in a rapidly evolving competitive environment.”

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 2 Buys and 4 Holds. The average price target stands at $11.33 implying downside potential of about 22.3% to current levels. Shares are up by about 53.5% since its listing on September 30.

Related News:

Rockwell Slips On 4Q Sales Miss; Analyst Stays Bullish

CyberArk’s 4Q Outlook Disappoints; Shares Drop 9%

GameStop To Redeem $125M In Notes Early; Street Sees 38% Downside