2020 saw some notable tech names opt for a public listing despite the COVID-19 disruptions. One such company is data analytics provider Palantir Technologies, which started trading on the NYSE in September via direct listing instead of the traditional IPO route. Founded in 2003, Palantir has been in the news due to some controversial contracts with government agencies.

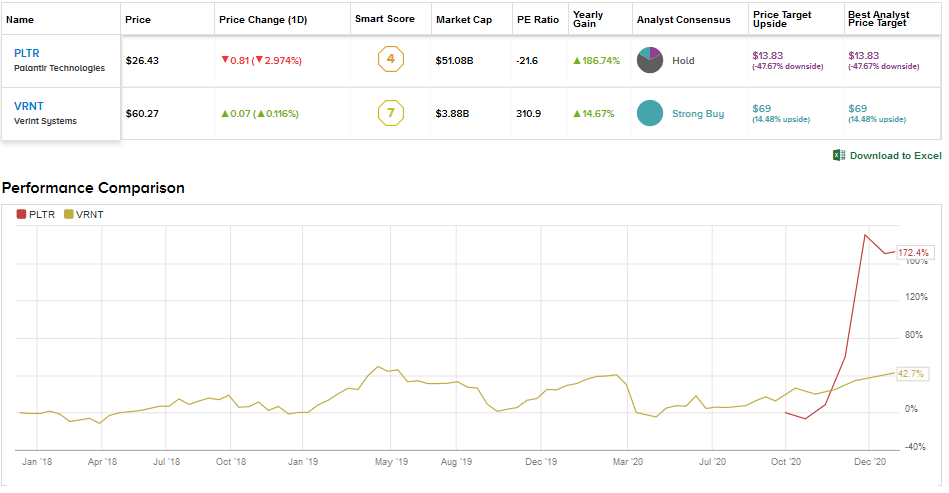

We will use the TipRanks Stock Comparison tool to pit Palantir against another SaaS (software as a service) stock, Verint Systems, and select the one offering better returns.

Palantir Technologies (PLTR)

Palantir provides data analytics software and services to public and private organizations with complex and sensitive data environments. More than half of the company’s revenue comes from government contracts. Critics often draw attention to some of the company’s controversial contracts, like the one to track undocumented immigrants, which have resulted in protest from social and political activists.

Nonetheless, the US government sector remains a primary area of focus for Palantir. In 3Q, it won a $91 million contract from the US Army and a $36 million contract from the National Institutes of Health (NIH). Earlier this month, the company was awarded a $44.4 million, three-year contract with the US FDA.

Palantir shares have exploded about 161% since the beginning of November, with the company’s stellar 3Q revenue growth being one of the reasons for the spike. Third-quarter revenue grew 52% year-over-year to $289 million. However, net loss increased substantially in 3Q due to stock-based compensation expenses related to the company’s direct listing. Palantir continues to be positive about its prospects in both the government and commercial spaces and sees more than 30% revenue growth in 2021.

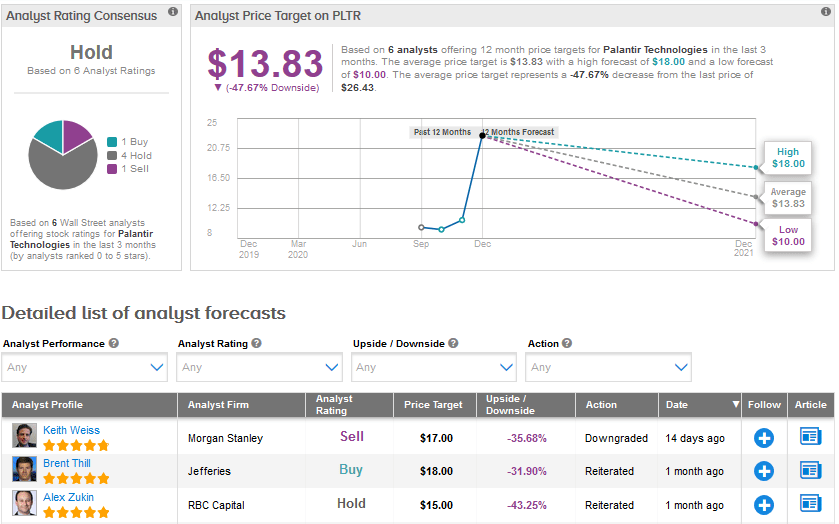

Earlier this month, Morgan Stanley downgraded its rating on Palantir to Sell from Hold with a price target of $17 (the previous target was $15), marking the second downgrade by the investment firm in less than a month. (See PLTR stock analysis on TipRanks)

Writing for Morgan Stanley, 5-star analyst Keith Weiss pointed to the staggering rise in the stock since its listing “with very little change in the fundamental story, the risk/reward paradigm shifts decidedly negative for the shares.” The analyst indicated that the company’s valuation is more than double that of the average SaaS stock.

Weiss also noted that Palantir’s strong 3Q results highlighted sustained momentum in the government vertical, accelerating growth in the enterprise business and record margins of over 25%, thus representing a slight fundamental “uptick” versus initial expectations. That said, he stated, “We believe much of incremental move since 3Q20 results (shares +75% over the past 2.5 weeks) are likely related to factors outside of fundamentals, including strong retail long-interest squeezing strong institutional short-interest.”

The Street is sidelined on Palantir, with the Hold analyst consensus based on 1 Buy, 4 Holds and 1 Sell. Given the recent surge, the average price target of $13.83 suggests a possible downside of 47.7% over the coming year.

Verint Systems (VRNT)

Verint provides customer engagement as well as data mining and intelligence solutions to government and enterprise clients. Last December, the company announced its intention to split into two independent publicly traded entities, one comprised of its Customer Engagement solutions business, and the other consisting of its Cyber Intelligence solutions segment. The spin-off of its Cyber Intelligence business is expected to be completed after the end of the current fiscal year (ending January 2021).

The company boasts a clientele base of over 10,000 organizations in over 180 countries and government agencies worldwide. Verint’s on-premises business took a hit in recent months due to the impact of the COVID-19 pandemic. However, last week, Verint saw an improvement in 3Q, with revenue rising 1% to $328 million on strength in cloud solutions and the recovery in the on-premises revenue. Adjusted EPS rose 8.5% to $1.02.

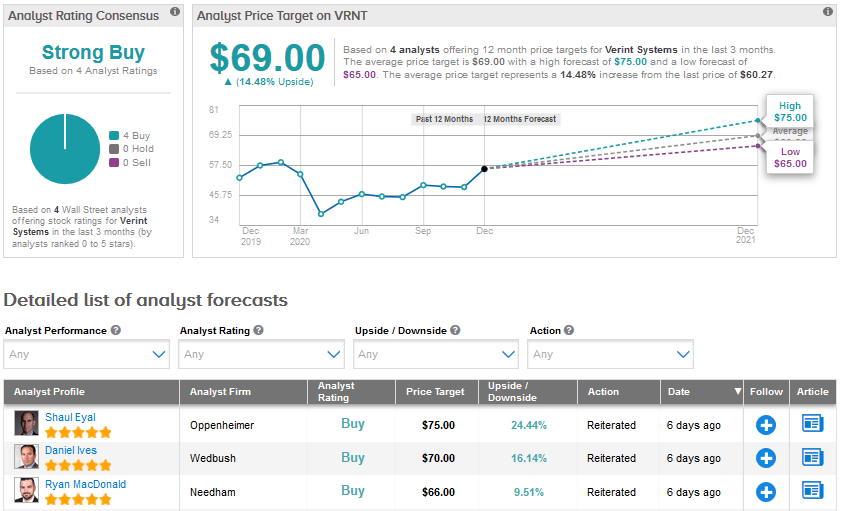

Following the 3Q earnings release, Needham analyst Ryan MacDonald reiterated a Buy rating on Verint and increased the price target to $66 from $64 on “increased confidence in the trajectory of growth and profitability in each business segment post-split.”

MacDonald noted that the company’s Customer Engagement and Cyber Intelligence businesses showed signs of recovery in 3Q. He stated “In CE, Verint experienced strong momentum in its cloud business. In CI, strong execution led to healthy gross margin expansion.” (See VRNT stock analysis on TipRanks)

“The separation of the two businesses remains on track to occur after the completion of FY21 and management provided a 3-year framework for revenue growth in each business that will see 30%+ for CE cloud and 10%+ growth for CI. When combining this with the expectation of post-split synergies, we are confident that Verint can deliver accelerating growth and margin expansion,” summarized MacDonald.

Looking ahead, Verint expects to benefit from rapid digital transformation, cloud migration and automation adoption. It anticipates its cloud revenue growth to accelerate to about 30% next year, driven by strong software bookings and SaaS conversions. It also expects the percentage of its recurring software revenue to increase to 85%, up 500 basis points year-over-year.

For now, the rest of the Street is also bullish on Verint with a Strong Buy analyst consensus. The average price target stands at $69, reflecting an upside potential of 14.5% in the months ahead. Shares have risen 8.9% year-to-date.

Bottom Line

Though Palantir is winning some big contracts in the government as well as private markets, the stock’s valuation currently looks quite lofty, especially given that the company isn’t profitable yet. Taking into account 4 unanimous Buys and the upside potential in the months ahead, Verint stock seems to be a better pick than Palantir.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment