Palantir Technologies (NYSE:PLTR), a data analytics company, announced that it had received an extension of one year to its prior four-year contract for the U.S. Army’s Vantage data management program. This contract is worth $115.04 million, inclusive of options.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As part of the contract extension, Palantir will “continue to provide its open data and analytics platform through continuous delivery to provide new AI-enabled capabilities and open platform infrastructure that promotes the program’s evolution to the Army Data Platform vision.”

Following the news of the extension, top-rated Bank of America (NYSE:BAC) analyst Mariana Perez termed it as “unexpected,” as the contract was set to expire this week. The analyst added that the Defense Department prefers multi-vendor awards but acknowledged Palantir’s strong position as a key provider of data analytics services.

Perez has a Buy rating and a price target of $21 on PLTR, implying upside potential of 13.3% at current levels.

Is Palantir a Buy, Hold, or Sell?

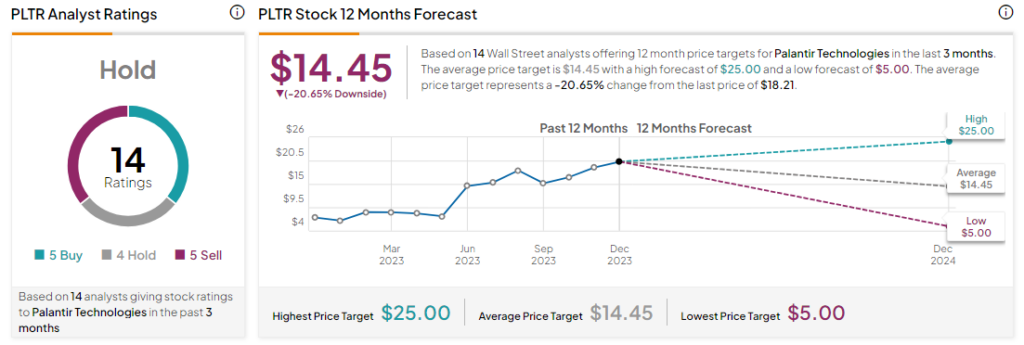

Analysts remain sidelined on PLTR stock, with a Hold consensus rating based on five Buys and Sell each and four Holds. In the past year, PLTR stock has jumped by more than 100%, and the average PLTR stock price target of $14.45 implies downside potential of 20.6% at current levels. This suggests that PLTR is overvalued at current levels.