Palantir (PLTR) did poorly in its Q2 earnings results, which were released earlier today. It had dropped more than 14.6% in pre-market trading, as investors react to the results. The stock carried these losses into regular trading hours.

This is the third consecutive quarter in which PLTR has missed earnings. It lost one cent per share, whereas analysts had forecast the software company to earn $.03 per share. The earnings miss can be attributed to the company’s investments in SPACs, which have been hit hard in 2022.

Revenue rose to $473 million, up 26% year-over-year, but that has not impressed investors sufficiently. This is because Palantir lowered its revenue forecast for the third quarter to a range of $474 million to $475 million. For reference, analysts were expecting $506.9 million. This also translates to a reduction in full-year revenue, as the company now projects a range of $1.9 billion to $1.902 billion.

The cut in revenue forecast can be attributed to the timing of large government contracts that are uncertain. As a result, Palantir’s CFO said that the revenue from these contracts is unpredictable.

Investor Sentiment is Waning

The sentiment among TipRanks investors is currently negative. Out of the 551,950 portfolios tracked by TipRanks, 5.6% hold PLTR. In addition, the average portfolio weighting allocated towards PLTR among those who do have a position is 5.51%. This suggests that the stock is fairly popular, and investors of the company are quite confident about its future.

However, this might change going forward as investor sentiment falls. Indeed, in the last 30 days, 1.1% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the following image:

Is Palantir a Buy, Sell, or Hold? It’s Quite Clear to TipRanks Investors

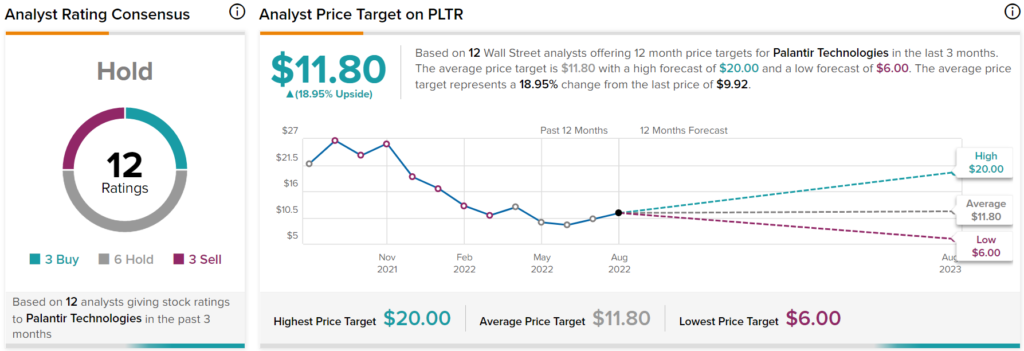

Anyone who had checked TipRanks’ database prior to the Q2 earnings release would have seen the writing on the wall. In the past month, the stock has seen two downgrades: first analyst Gabriela Borges of Goldman Sachs downgraded PLTR from a Buy to a Hold, and then analyst Brian White of Monness did the same.

Moreover, three analysts have reiterated their Sell ratings in the past three months. Altogether, the average analyst consensus on Palantir stock is a Hold, with an average upside of 19% following today’s selloff.

However, it’ll be interesting to see what changes analysts will make after today’s revised guidance. It’s likely that more price targets will be cut in response.

In addition, the case against the stock was strengthened by TipRanks’ Smart Score of 1, indicating the stock would underperform the market. Year-to-date, the stock has dropped by more than 38%.

Is Palantir Stock a Good Long-Term Investment?

It’s tough to say whether Palantir is a good long-term investment. On the one hand, the company is growing fast while generating positive free cash flow. On the other hand, stock-based compensation (SBC) continues to be very high, which dilutes shareholders. For reference, SBC in the last 12 months as a percentage of market cap was 3.2%. Thus, the answer to the question will likely depend on the company’s ability to lower SBC expenses.

However, it’s worth mentioning that Palantir’s CEO is a strong believer that stock-based compensation motivates employees to perform better, as it creates an ownership mentality. Therefore, it is likely that SBC will remain high for quite some time going forward.