Shares of Israel-based fintech firm Pagaya Technologies (NASDAQ: PGY) jumped 73.1% on Tuesday, July 26, after declining more than 17% on Monday. Pagaya stock soared nearly 119% last Friday. The stock has been highly volatile over recent days. Including yesterday’s spike, Pagaya stock has advanced more than 189% over the past five days.

In the absence of any major news, the low-float stock (implies that only a small percentage of shares are publicly trading) seems to be surging due to the possibility of a short squeeze.

More on Pagaya

Pagaya leverages artificial intelligence and machine learning to provide real-time customer credit evaluation to financial services providers. Pagaya’s revenue surged by an impressive 379% to $475 million in 2021. The company recently went public through a SPAC (special purpose acquisition company) combination with EJF Acquisition Corp.

Last week, Pagaya filed a prospectus with the U.S. Securities and Exchange Commission (SEC) related to the potential sale of its stock. As per the prospectus, selling shareholders may offer up to 673 million shares. Furthermore, Pagaya may issue up to 46.1 million Class A shares upon the exercise of warrants.

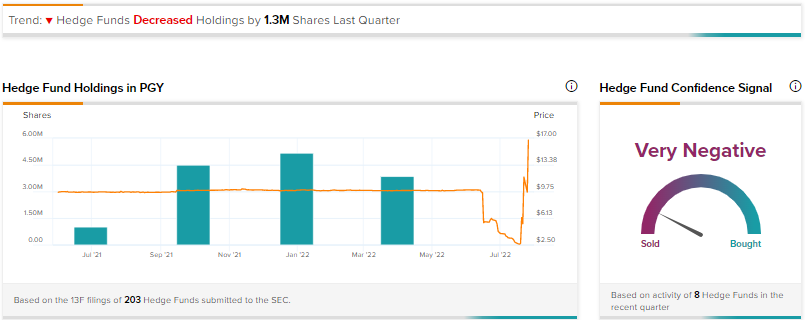

Hedge Funds Seem Uninterested

As per TipRanks’ Hedge Fund Trading Activity tool, the Confidence Signal for Pagaya is Very Negative based on the activity of eight hedge funds in the last quarter. Overall, hedge funds decreased their holdings in Pagaya by 1.3 million shares in the last quarter.

Conclusion

Pagaya stock’s low float makes it an easy candidate for price manipulation. While the company’s business model seems interesting, the stock is very volatile and does not seem suitable for risk-averse investors.

As per TipRanks Smart Score System, Pagaya scores a one out of 10, which indicates that the stock could underperform the broader market.