Texas-based software firm Oracle Corp. (ORCL) has signed an agreement to acquire healthcare IT firm Cerner Corp. (NASDAQ:CERN) for nearly $28.3 billion.

Oracle’s shares closed 5.1% down on Monday. However, they gained 0.6% in the extended trading session to end the day at $92.20.

Meanwhile, Cerner gained 0.8% to close at $90.49. The stock went up another 0.1% in after-hours trading.

Transaction Details

As per the terms of the agreement, Oracle will acquire all the shares of Cerner through an all-cash tender offer for $95 per share.

The acquisition is expected to close next year.

Commenting on the deal, the CEO of Oracle, Safra Catz, said, “We expect this acquisition to be immediately accretive to Oracle’s earnings on a non-GAAP basis in the first full Fiscal Year after closing—and contribute substantially more to earnings in the second Fiscal Year and thereafter.”

“Oracle’s revenue growth rate has already been increasing this year—Cerner will be a huge additional revenue growth engine for years to come as we expand its business into many more countries throughout the world,” Catz added.

About Cerner

Headquartered in Missouri, Cerner provides healthcare information technology services, devices, and hardware. It offers an integrated clinical and financial systems to help manage the day-to-day revenue functions of healthcare providers, as well as a wide range of services to support operational needs.

Wall Street’s Take

Following the announcement, Morgan Stanley (MS) analyst Ricky Goldwasser upgraded the rating on Cerner to Hold from Sell and raised the price target from $77 to $85 (6.1% downside potential).

Additionally, Piper Sandler (PIPR) analyst Jeff Garro reiterated a Buy rating on the stock and increased the price target to $95 from $89 (5% upside potential).

Garro expects the merger to take place, with Cerner’s “shareholder-friendly board” supporting the takeover.

Overall, the stock has a Hold consensus rating, based on 3 Buy and 9 Holds. The average Cerner stock prediction of $87.70 implies 3.1% downside potential. Shares have gained 18.2% over the past year.

Risk Analysis

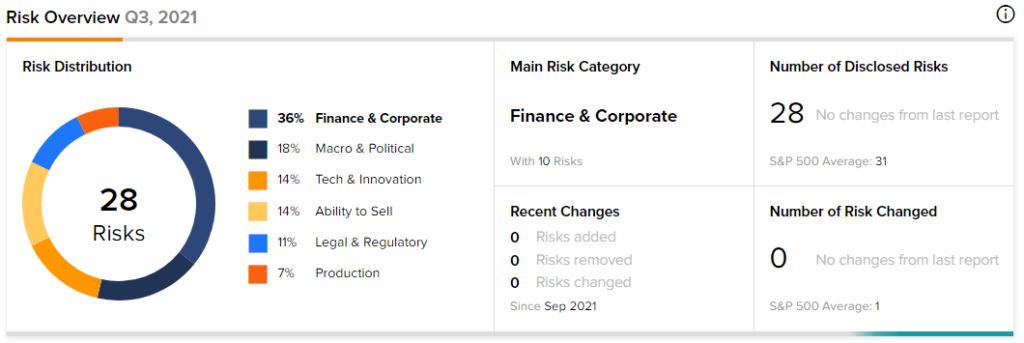

According to TipRanks’ Risk Factors tool, Cerner is at risk mainly from one factor: Finance & Corporate, which accounts for 36% of the total 28 risks identified for the stock. Under the Finance & Corporate risk category, Cerner has 10 risks, details of which can be found on the TipRanks website.

About Oracle

Oracle offers database software and technology, cloud-engineered systems, and enterprise software products, such as enterprise resource planning software, human capital management software, customer relationship management software, enterprise performance management software, and supply chain management software.

Overall, the stock has a Moderate Buy consensus rating based on 7 Buys and 13 Holds. The average Oracle price target of $105.00 implies 14.6% upside potential. Shares have gained 43.8% year-to-date.

Furthermore, TipRanks data shows that financial blogger opinions are 85% bullish on the stock, compared to the sector average of 70%.

Related News:

Winnebago Industries Reports Record Q1 Results; Shares Rise

Tesla Sued over Musk’s Stock Sales Tweets — Report

BNP Paribas to Sell Subsidiary, Bank of the West, for $16.3B