It’s been a big few days for Oracle (NYSE:ORCL), as the software giant announced several new moves that should help make it an even stronger force in the field. It’s added a few new features to some of its established software and made a critical new acquisition as well. Investors are at least modestly pleased, and Oracle is in the green—if only just—up fractionally in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

First, Oracle made some steps of its own into the rapidly growing AI front, adding a set of generative AI tools to its NetSuite financial software. With these tools, users can now automatically write collection letters or engage in certain other standard financial tasks. It’s supposed to make the jobs of financial professionals easier, noted executive vice president Evan Goldberg, but it’s easy enough to wonder how many jobs it will render redundant. Further, Oracle bought Next Technik, a field management solutions operation, which will give Oracle access to several more tools once they’re properly incorporated.

Then, just to round it all out, Oracle joined up with several law enforcement and public safety organizations in four states as they turned to Oracle’s line of public safety tools. With these, these public safety agencies can improve their communications and situational awareness and hopefully improve outcomes as well. With the Oracle Public Safety Services Suite, agencies benefit from Oracle’s years of experience herein as well as the sheer size and value of Oracle Cloud.

Is Oracle a Buy, Sell, or Hold?

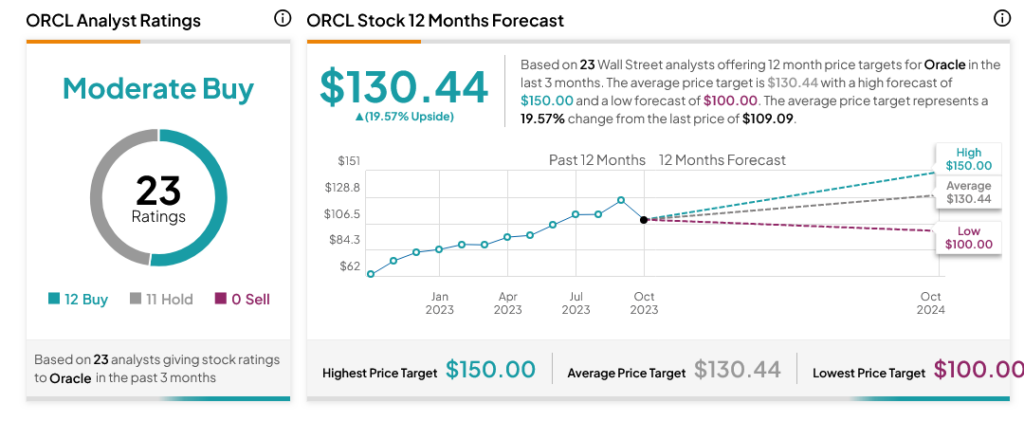

Turning to Wall Street, analysts have a Moderate Buy consensus rating on ORCL stock based on 12 Buys and 11 Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average ORCL price target of $130.44 per share implies 19.57% upside potential.