Oppenheimer raised Marvell Technologies’ price target to $40 (19.5% upside potential) from $35 and reiterated a Buy rating on the stock ahead of the integrated circuit maker’s 2Q results on Aug. 27.

Oppenheimer analyst Rick Schafer wrote in a note to investors that Marvell Technologies (MRVL) remains his “top 5G RAN play.” Schafer sees upside setup driven by 5G and DC/Cloud.

“In 5G, we see incremental $2B/year of RAN revenue within 3–4 years. MRVL has >$3K/BTS 5G RAN content with Samsung, ~$400/BTS at ERIC/ZTE and NOK (~$1200/BTS, ramps 4Q),” the analyst wrote in a note to investors. “Cloud (>10% of revenues), the second leg of MRVL’s growth story, presents a larger opportunity than 5G. MRVL remains our top 5G RAN play. DC/Cloud presents upside optionality.”

Strong demand for networking products from 5G infrastructure and datacenter end markets are driving Marvell’s revenues. In 1Q, the company’s revenues and adjusted EPS increased by 4.7% and 12.5%, respectively, on a year-over-year basis. (See MRVL stock analysis on TipRanks).

For 2Q, Marvell anticipates revenues of approximately $720 million (+/- 5%), indicating a year-on-year growth of 9.7%. Its adjusted EPS guidance range of $0.17-$0.23 signifies an increase of 6%-44% from the year-ago quarter’s earnings of $0.16.

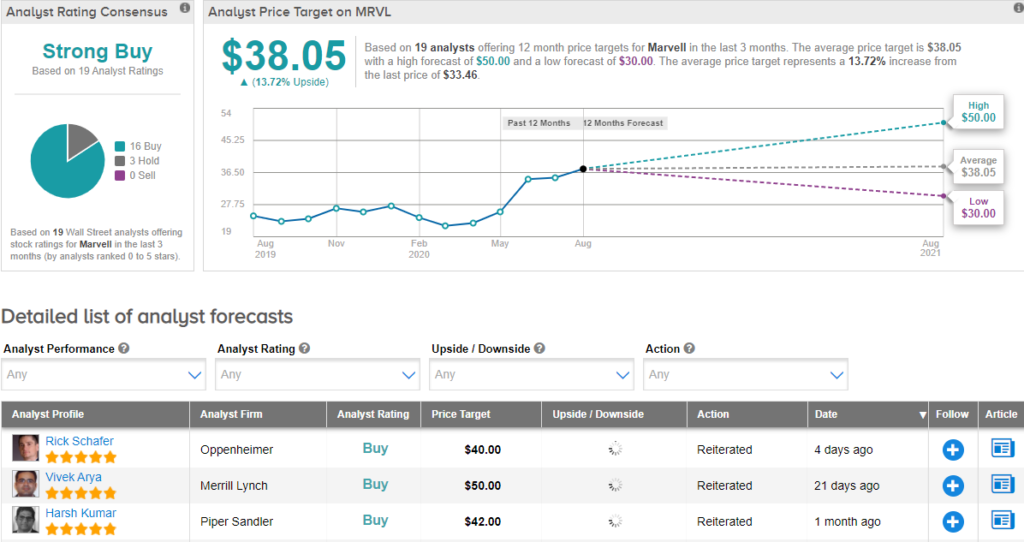

Currently, the Street has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 16 Buys and 3 Holds. The average price target of $38.05 implies an upside potential of about 13.7%. Shares are up 26% year-to-date.

Related News:

Deere Gains 4% On Raised 2020 Profit Outlook

Susquehanna Raises Keysight’s PT On 5G Rollout Boost

D.A. Davidson Lifts BJ’s PT On Growth Prospects