Shares of Texas-based Open Lending Corp. (LPRO) gained 17.6% in Tuesday’s extended trade after the company posted strong financial results for the second quarter of 2021. Open Lending offers default insurance, risk modeling, risk-based pricing and loan analytics to auto lenders.

Earnings per share (EPS) came in at $0.60, compared to a loss of $1.01 in the second quarter of 2020. Further, it beat the Street’s estimate of $0.17. Total revenue increased 177% year-over-year to $61.1 million, exceeding analysts’ expectations of $48.98 million.

Program fees rose to $20.6 million from $8.8 million in the previous year. Claims administration service fees amounted to $1.7 million, up from $1.1 million. Furthermore, the company facilitated 46,408 certified loans, compared to 18,684 in the year-ago quarter.

The Chairman and CEO of Open Lending, John Flynn, said, “We continue to make progress on our growth strategies to capture more of the $250 billion addressable market and help underserved consumers get auto loans. Looking ahead, our pipeline of the new credit union and regional bank customers is strong and there remains a large opportunity in front of us to grow our OEM captive business.”

Meanwhile, the company reaffirmed its guidance for 2021 on the basis of its second-quarter results. It expects revenue in the range of $184 million to $234 million. (See Open Lending stock chart on TipRanks)

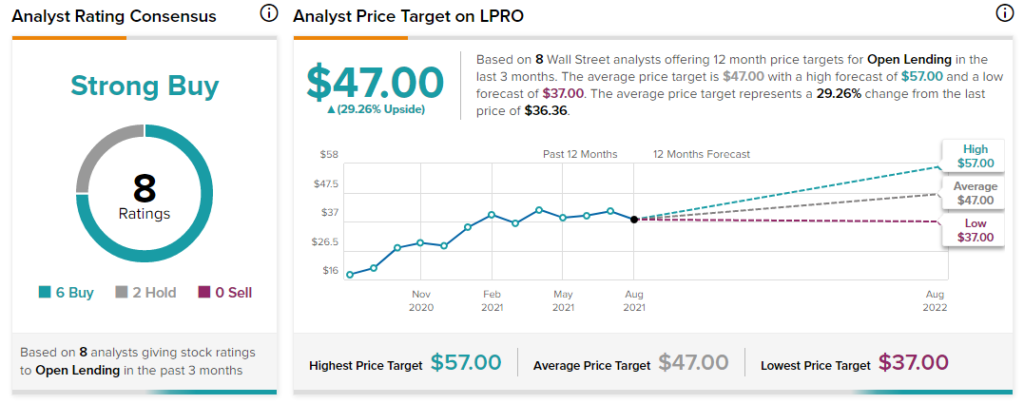

On August 3, Stephens analyst Vincent Caintic maintained a Buy rating on the stock with a price target of $47 (29.3% upside potential).

The analyst says that Open Lending has a strong risk/reward profile “given the combination of low expectations and the belief that Open Lending will execute on meeting the midpoint of its 2021 guidance ranges.”

Overall, the stock has a Strong Buy consensus based on 6 Buys and 2 Holds. The average Open Lending price target of $47 implies 29.3% upside potential. Shares of the company have gained 94.7% over the past year.

Related News:

Unity Software Q2 Results Top Estimates; Street Says Buy

Sysco Fiscal Q4 Results Beat Estimates; Raises EPS Guidance

PubMatic Q2 Results Beat Estimates; Shares Rise 2.8%