onsemi (NASDAQ: ON) has announced encouraging results for the second quarter of 2022. Shares of the company slipped 4.7% on August 1, following the results. However, the stock was up 2.9%, at the time of writing, on Tuesday

The company saw its adjusted earnings rising to $1.34 per share in the second quarter of 2022, up from 63 cents per share in the year-ago period. The metric also surpassed analysts’ estimate of $1.26 per share.

Revenues for the reported quarter came in at $2.09 billion, up 25% from the year-ago period. The figure easily surpassed expectations of $2.01 billion.

ON has been witnessing record strength in its automotive and industrial end markets. The revenues from these spaces together make around 66% of onesemi’s overall business.

onsemi saw a 38% year-over-year rise in the automotive and industrial end markets in the reported quarter.

Segment-wise, revenues from the company’s Power Solutions Group (PSG) increased 25% year-over-year to $1.06 billion in the reported quarter.

Revenues from Advanced Solutions Group (ASG) rose 18% from the year-ago period to $716.7 million. Further, revenues of Intelligent Sensing Group (ISG) surged 44% year-over-year to $311.3 million.

The adjusted gross margin rose 1,130 basis points to 49.7% in the second quarter of 2022.

ON’s Q3 Outlook Looks Promising

onsemi has provided guidance for the third quarter of 2022. It expects to report adjusted earnings in the range of $1.25-$1.37 per share. The Street expects the company to post earnings of $1.25 per share in the third quarter.

Further, revenues are anticipated in the range of $2.07-$2.17 billion against analysts’ estimates of $2.06 billion.

The President and CEO of onsemi, Hassane El-Khoury, said, “While we are optimistic about our outlook, we remain sensitive to dynamic market conditions.”

Street Is Cautiously Optimistic about ON Stock

On TipRanks, the Street is cautiously optimistic about ON stock, which has a Moderate Buy consensus rating based on 13 Buys and five Holds. ON’s average price forecast of $69.44 implies 8.6% upside potential to current levels. Shares of the company have lost 9.3% so far this year.

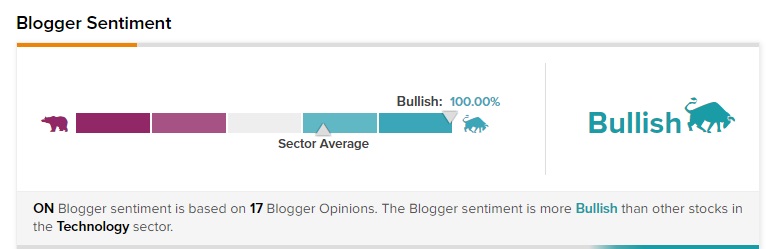

TipRanks data shows that financial bloggers are 100% Bullish on ON, compared to the sector average of 66%.

Key Takeaways for ON Investors

onsemi is witnessing solid growth in the automotive and industrial end markets. Several favorable trends like vehicle electrification and safety, sustainable energy grids, industrial automation, and 5G and cloud infrastructure within these end markets should prove to be beneficial for the company. However, macroeconomic challenges like supply-chain disruptions, COVID-19 uncertainty, and the Russia-Ukraine conflict can weigh on the company’s financials going forward.

Read full Disclosure.